Private nonprofit colleges and universities across the United States continue to grapple with pervasive financial challenges. Long-term demographic changes are leading to declines in enrollment; negative endowment investment returns, as documented by the 2016 NACUBO-Commonfund Study of Endowments (NCSE), are causing added financial pressures. Furthermore, some institutions such as Santa Fe University of Art and Design, N.M., and Saint Joseph’s College, Rensselaer, Ind., have announced impending closures or suspensions of operations in the 2016–17 academic year. While higher education has a history of both expansion and contraction, including institutional closures and mergers, all these factors converging simultaneously mean that today’s higher education institutions find themselves in uncertain territory.

The 2016 NACUBO Tuition Discounting Study (TDS) was conducted against this turbulent backdrop. The study, which has been produced annually by NACUBO since 1994, measures not only tuition discounting at private nonprofit institutions for both first-time, full-time degree- or certificate-seeking freshmen and all undergraduates, but also the trends in need- and merit-based financial aid, net tuition revenue, and strategies that institutions employ to increase net tuition revenue. In 2016, 963 private nonprofit NACUBO member institutions were invited to participate, and 411 institutions (roughly 43 percent) provided usable data.

The study specifically defines each institution’s tuition discount rate as “its total institutional grant aid awarded to first-time, full-time, degree- or certificate-seeking first-year undergraduates as a percentage of its gross tuition and fee revenue collected from freshmen students.” The institutional discount rate for all undergraduates uses the same percentage formula, but is based on revenue and grant dollars from all students enrolled in undergraduate programs.

Reaching an All-Time High

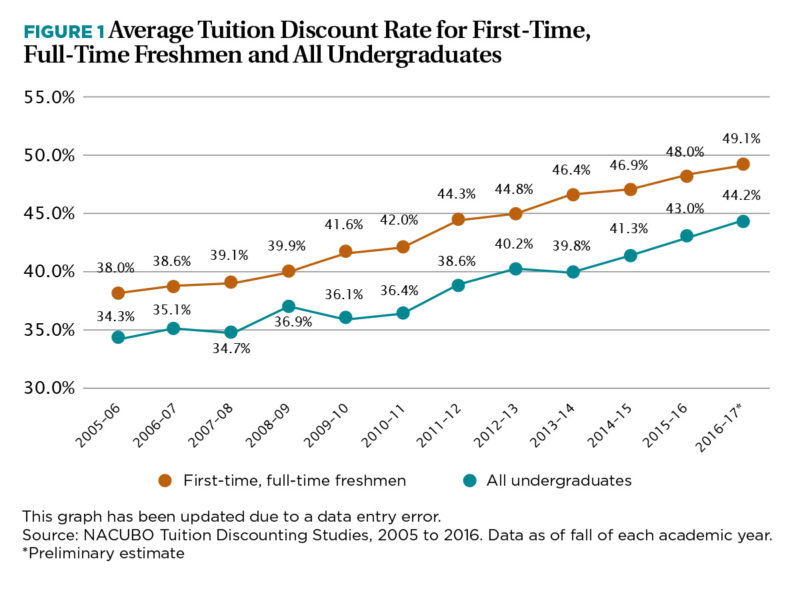

TDS data over the past 10 years show steadily rising tuition discounting percentages for first-time, full-time freshmen (see Figure 1). In 2005–06, the tuition discount rate for first-time, full-time freshmen was 38 percent; five years later, it had risen to 42 percent, and by 2015–16, it jumped to a new study record of 48 percent, which is a 6 percentage-point increase from 2010–11, and a 10 percentage-point increase from 2005–06.

Natural variations. The estimated first-time, full-time freshman tuition discount rate for 2016–17 is 49.1 percent, which is yet another record for the TDS. But when considering the data and their implications for higher education institutions, it is important to keep in mind that the study’s tuition discount rates are an average of hundreds of institutions’ data. Thus, variations naturally occur within the data given the range of institutional missions and educational programs, endowment levels, and student demographics among respondents. The 2015–16 freshman tuition discount ranged from just over 41 percent (the lower 25th percentile) to slightly more than 56 percent (the 75th percentile).

The upward trend in institutional discount rates for all undergraduate students is somewhat similar. From 2005–06 to 2015–16, the average tuition discount rate for all undergraduates moved from 34.3 percent to 43 percent, an 8.7 percentage point increase. The estimated average discount rate for 2016–17 was 44.2 percent, a new record high for the TDS series.

Again, there were noticeable differences within the distribution of discount rates around the average level. The 25th percentile for the all undergraduates rate was 35 percent, and the 75th percentile was a little over 51 percent.

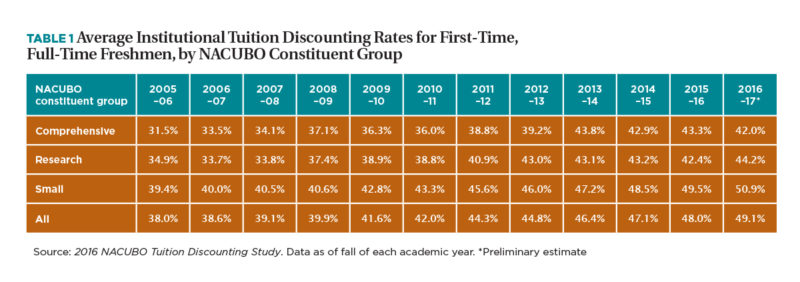

Differences by constituent group. When analyzing the freshmen tuition discount data by NACUBO constituent groups—consisting of comprehensive, research, and small institutions—there are variances as well (see Table 1). The discount rate for small institutions grew from 39.4 percent in 2005–06 to 49.5 percent in 2015–16, and reached an estimated 50.9 percent in 2016–17; if the estimated 2016–17 rate holds true after final data are collected in fall 2017, it would mark the first time that any average NACUBO constituent group tuition discounting rate reaches 50 percent.

However, the story differs for the two other constituent groups. Comprehensive institutions’ average freshmen discount rate in 2005–06 was 31.5 percent, the lowest of the three constituent groups in that year’s survey. By 2015–16, the rate had increased to 43.3 percent. The estimated 2016–17 discount rate for comprehensive institutions is 42 percent—down slightly from 2015–16, but still an increase of 10.5 percentage points from 2005–06.

The average freshmen institutional discounting rate for research institutions rose from 34.9 percent in 2005–06 to 42.4 percent in 2015–16, a total increase of 7.5 percentage points. The estimated freshmen discount rate for 2016–17 is 44.2 percent, which would be 6.7 percentage points lower than that of small institutions, while being 2.2 percentage points higher than comprehensive institutions.

These findings reinforce that looking both at differences between constituent groups and overall data is necessary to understand the variations of tuition discounting across higher education institutions.

Lower Growth in Net Tuition Revenue

Tuition discount rate is only one component of tracking the effects of institutional grants on private nonprofit college and university finances. Another important element is net revenue, defined in the TDS as “gross tuition and fee revenue minus institutional financial aid expenditures.” When looking at net revenue in the context of tuition discounting, the ideal is to have gross tuition and fee revenue rise faster than institutional grant aid awards so that new revenue covers the cost of those institutional aid discounts. The opposite scenario, grant dollars rising more quickly than revenue, can cause net revenue declines.

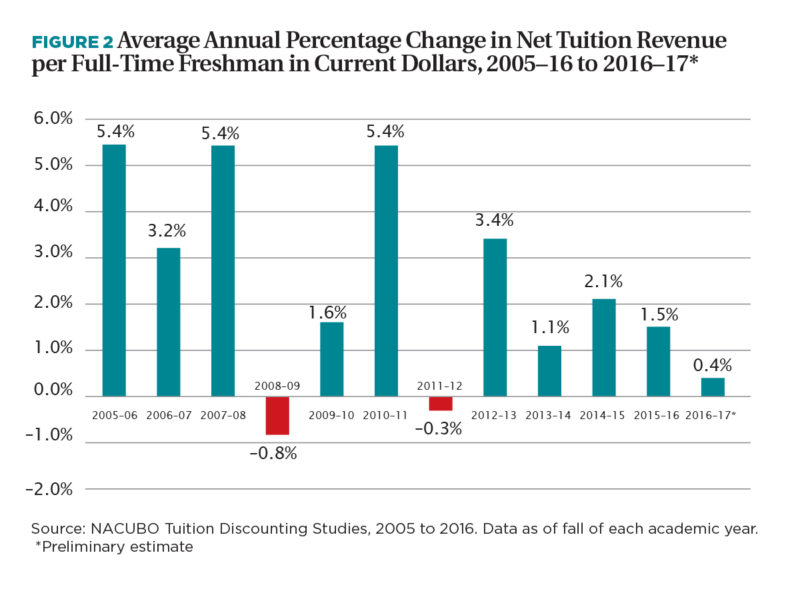

Revenue volatility. Over the past 10 years (see Figure 2), the average net revenue received from freshmen in current dollars has been quite volatile. For instance, while average revenue per first-time freshman increased by 5.4 percent in 2005–06, it plummeted to to –0.8 percent in 2008–09, likely a result of the Great Recession. Since that 2008–09 negative return, the average has bounced up and down, including another negative return of –0.3 percent in 2011–12, but has not risen to its prior peaks; in 2015–16, the net revenue increased by only 1.5 percent.

The net tuition revenue estimate of 0.4 percent per full-time freshman for 2016–17 is the lowest positive return recorded in this 10-year period. If it holds true, it will remain below the rate of inflation as measured by the Higher Education Price Index, which rose by an estimated 1.8 percent in FY16, according to the Commonfund Institute. This means that in “real” (i.e., inflation-adjusted) dollars, net revenue actually declined.

Results by sector. As with tuition discounting rates, the net tuition revenue story differs by institutional sector. Small institutions achieved average net revenue growth of 3 percent in 2005–06, compared with 6 percent at research institutions and 7.6 percent at comprehensive institutions. By 2015–16, small institutions’ net tuition revenue per freshman was only 1.5 percent, versus 3.7 percent at comprehensive institutions, and 2.2 percent at research universities.

Small institutions’ estimated average net tuition revenue for 2016–17 is only 0.2 percent compared with 2.6 percent at research universities and 2.1 percent at comprehensive institutions. If both this estimate and the estimated 50.9 percent tuition discount rate in 2016–17 for small institutions hold true in the next TDS, the combination points toward more uncertainty for this institutional sector, in particular.

Strategies and Sustainability

These two trends—rising tuition discount rates and lower growth in net tuition revenue—bring to mind two important questions for the future: How do private nonprofit institutions strategize to increase net tuition revenue in an uncertain climate for higher education? And are current tuition discounting rates sustainable?

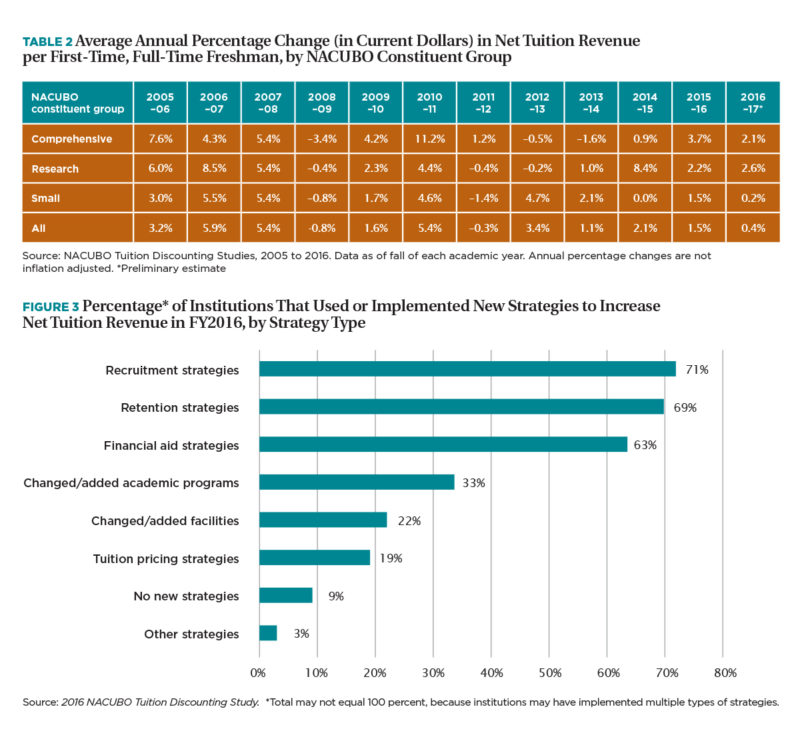

The TDS asked respondents about both their strategies to increase net tuition revenue and whether they felt tuition discounting was sustainable at their institutions. In this iteration of the survey, the strategy question was redesigned as a multiple-choice question with more than one allowable answer choice and additional opportunity for open-ended text responses to allow better analysis of survey participants’ thoughts and opinions.

As can be seen in Figure 3, approximately 71 percent of respondents to the strategy question indicated they employed recruitment strategies to increase net tuition revenue, followed by retention strategies (69 percent of respondents), financial aid strategies (63 percent), and changing/adding academic programs (33 percent). About 22 percent of respondents said they had changed/added facilities, 19 percent had employed tuition pricing strategies, and 3 percent indicated they had employed other strategies. Roughly 9 percent of respondents said they had not employed any new strategies.

Revenue improvement. Respondents also offered several illuminating comments on their institutions’ strategies for increasing net tuition revenue. Some schools appear to have a broad-based approach to attracting a wide variety of students as a way to grow their revenues. For example, a survey participant from a comprehensive institution in the West, said that “chief among [our institutional strategies] is increasing retention and success, thus decreasing lost revenue from student attrition.”

Other commentators indicated that their goal is to focus on recruiting and retaining particular student populations. For instance, recruiting athletes was mentioned by multiple institutions in different contexts. Some commented about focusing on or expanding athletic recruitment, while others noted they had also upgraded their athletic facilities. International students were also mentioned by a small institution in the Great Lakes region as a focus of recruitment “both to diversify our campus and to lower our discount.” Financial aid–related responses from small and comprehensive institutions in the Mid-Atlantic, Great Lakes, and West regions included both increases and decreases in merit aid, targeting particular populations for scholarships, and using consulting services to help fine-tune financial aid packaging.

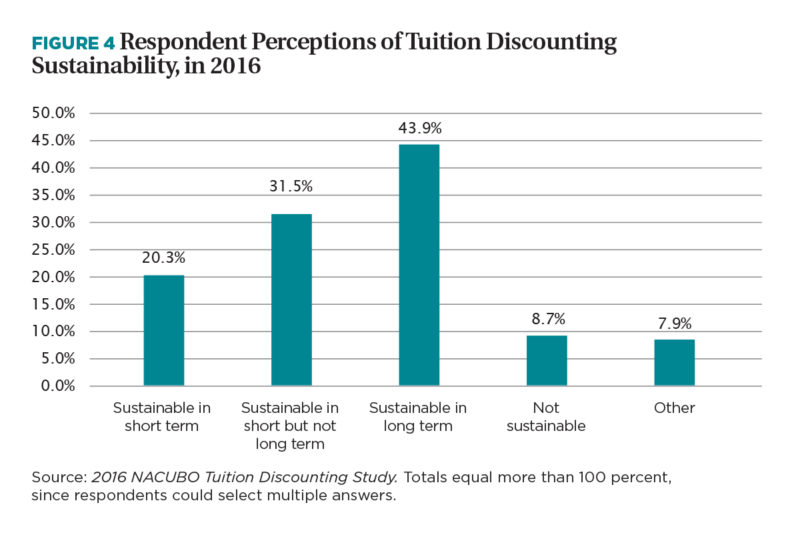

Regardless of the strategy chosen, the plurality of institutions seem to believe that their current tuition discount practices are sustainable. As Figure 4 shows, 43.9 percent of respondents thought their institutional tuition discounting practices were sustainable in the long term, followed by 31.5 percent who thought they were sustainable in the short but not the long term. Only 8.7 percent thought their tuition discounting practices were not sustainable.

However, respondents were careful to make important caveats to their views on tuition discounting sustainability, often noting that their answers would depend on how their previously described strategies played out. As a survey participant from a small institution in the Great Lakes region commented, “We want to be a generous college, but responsibly generous.” Another respondent, from a small institution in the Mid-Atlantic, noted that both recruiting and retaining students “require not only optimal discounting strategies but also a clear articulation and demonstration of the value of the degree—academic programs/opportunities for out-of-class experiences/internships/grad school/jobs.” A third survey participant, from a small institution in New England, said, “We continuously educate our families on the value of the education a student will receive from attending our college.” Finally, a respondent from a small institution in the Mid-Atlantic observed, “It is a very volatile market and will continue to be in the foreseeable future.”

The results from the 2016 TDS echo this observation, with rising tuition discount rates and low growth in net revenue. Institutional strategies are highly contextual and depend on their particular locations, institutional missions, and financial resources. Some strategic themes are clear: for instance, focusing on recruitment, retention, and financial aid as three main strategy drivers to increase net tuition revenue. And a good number of institutions surveyed think that their tuition discounting strategies are sustainable in the long term. However, it remains to be seen, as respondents prudently note, if the combination of these strategies and the current discounting rate trends will bring the results that institutions are seeking.

LESLEY McBAIN is an assistant director, research and policy analysis, NACUBO.