Each year since we emerged from the Great Recession more than a decade ago, financial markets have faced a cascading series of challenges—and FY19 was no exception. The period of July 1, 2018–June 30, 2019, featured rising tariffs and counter-tariffs imposed by the United States and China in their tit-for-tat trade war; fears of an imminent economic recession; and the longest partial shutdown of the U.S. federal government in history.

Despite these obstacles, the U.S. stock market continued to power forward. The Standard & Poor’s 500 index, the most commonly used measure of domestic equities, jumped 10.4 percent during FY19; foreign stocks, by comparison, grew only 1.3 percent, as reported by the Morgan Stanley Capital International (MSCI) index of non-U.S. securities. American stocks were buoyed by the overall strength of the domestic economy, which entered its 11th consecutive year of expansion during FY19. Domestic equities were further fueled by cuts in the short-term interest rates controlled by the Federal Reserve; sharp increases in federal spending; low inflation; continued increases in corporate earnings; and a 50-year low in the unemployment rate.

The one-year investment performance of American college and university endowments and affiliated foundations mostly lagged the major American index, however. U.S. endowments returned just 5.3 percent (net of external management fees and expenses) in FY19, compared with a more robust 8.2 percent return in FY18, according to the final results of the 2019 NACUBO-TIAA Study of Endowments (NTSE). Despite these below-average one-year gains, many institutions were able to achieve substantially higher 10-year average annual net returns that, for the first time in a decade, met their long-term growth targets. But with many challenges ahead in the world markets, should investment managers expect these higher long-term gains to continue?

Higher Long-Term Gains

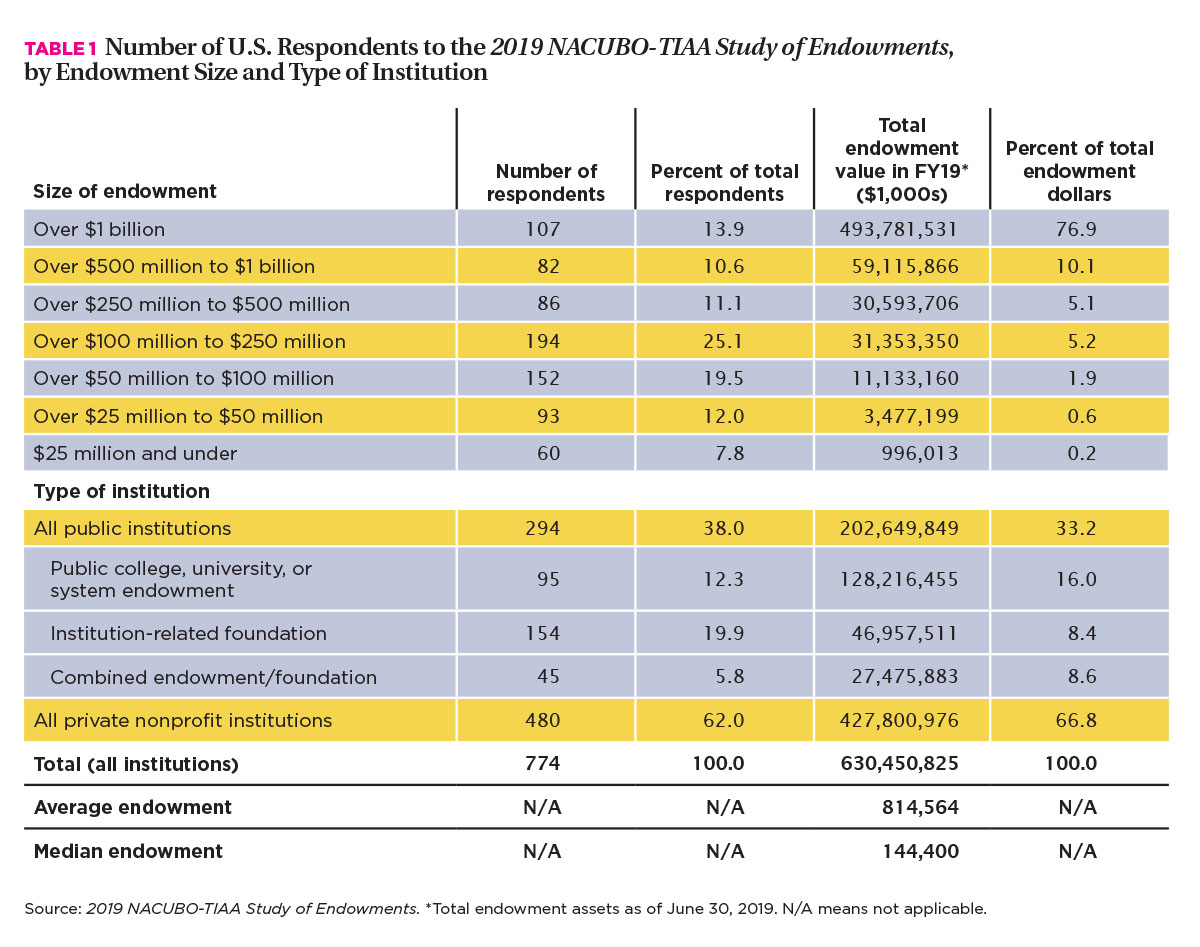

The 2019 NTSE comprises 774 participating U.S. college and university endowments and affiliated foundations (Table 1). These institutions held nearly $630.5 billion in total endowment assets as of the end of FY19; the average endowment among the participants was $814.6 million, and the median was $144.4 million. Roughly 14 percent of the participating institutions had more than $1 billion in total endowed funds; these highly endowed schools held more than three-quarters of total endowment assets.

The NTSE, a joint partnership between NACUBO and TIAA, is the largest annual study of college and university endowments in North America. “We remain committed to this extensive research effort,” says Kevin O’Leary, chief executive officer of TIAA endowment and philanthropic services. “The NTSE continues to provide valuable insights into endowment investment performance, asset allocations, and governance for institutional managers, and we are pleased and proud to be part of it.” Susan Whealler Johnston, NACUBO president and CEO, adds, “Our partnership with TIAA allows us to provide thought leadership from the best minds on endowment management. As a result, the study remains the most recognized source of information for institutions to gain new knowledge regarding endowment performance and best practices.”

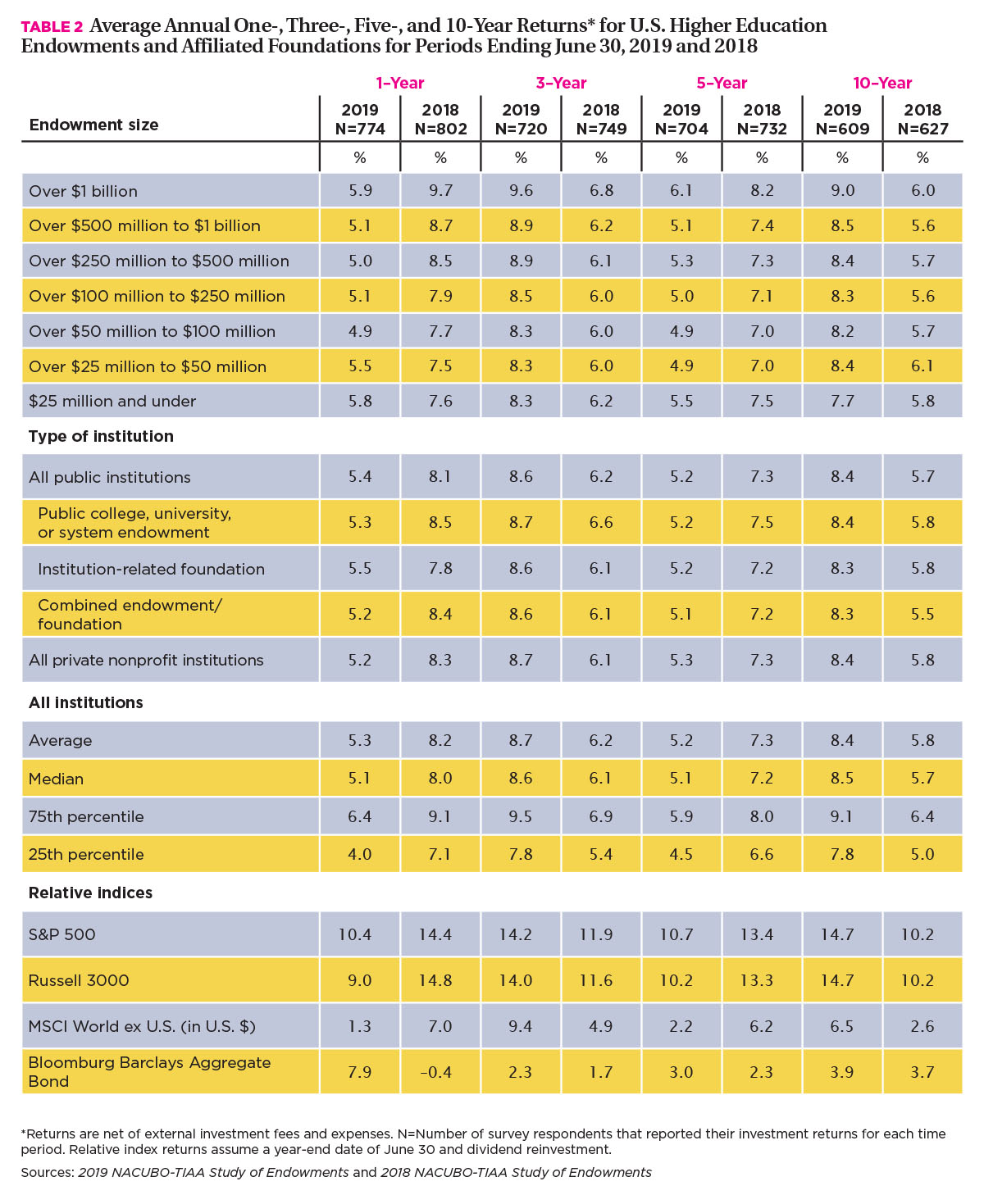

Overall, at all endowment size levels, the average annual 10-year net returns were much higher for the decade ending June 30, 2019, than those reported last year (Table 2), due in large part to the fact that the very low returns from FY09 of the Great Recession are no longer included in the 10-year calculations. Consequently, these stronger long-term results better reflect the more recent gains in the financial markets during the past decade, especially for the largest endowments.

On average, schools with more than $1 billion in total endowed assets saw a 9 percent 10-year average annual net return in FY19, compared with 8.5 percent among NTSE participants with endowments valued between over $500 million and $1 billion, 7.7 percent for those with market values $25 million and under, and 8.4 percent among NTSE participants overall. As a result of these stronger long-term returns, nearly 80 percent of institutions with long-term return objectives were able to meet their 10-year return targets in FY19. In FY18, only 18 percent of institutions that had 10-year long-term return targets met or exceeded their return objectives.

“The increase in long-term results is welcome news,” O’Leary says. “These results indicate that endowments were generally able to preserve their purchasing power after spending distributions. The lower short-term returns, however, are a bit concerning.”

Indeed, it should be noted that the one-year return results for FY19 were much weaker, on average, than for FY18 (Table 2). Schools with the largest endowments saw overall net returns of 5.9 percent in FY19, compared with 9.7 percent in FY18; the smallest endowments saw their one-year average returns drop from 7.6 percent in FY18 to 5.8 percent in FY19.

Underperformance of Nontraditional Asset Classes

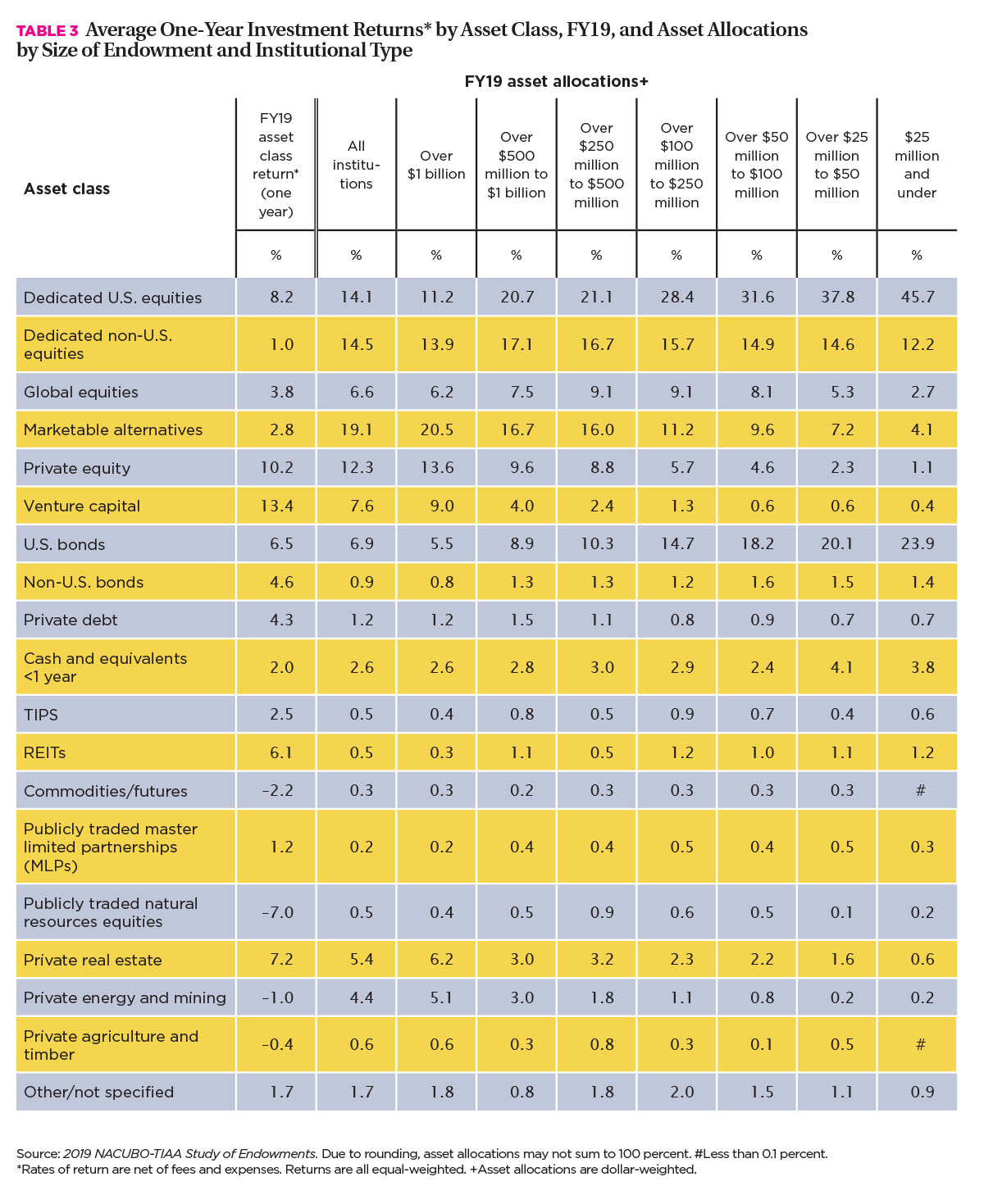

These lower one-year numbers may be due in part to the relatively high proportion of investments that many endowments have in nontraditional asset classes. As long-term investment vehicles, endowments tend to be more heavily invested in commodities, marketable alternatives/hedge funds, natural resource funds, and other illiquid investments. Prior research has shown that, in the long run, these alternative asset strategies can boost performance, but in FY19 several of these assets underperformed relative to U.S. equities (Table 3).

In FY19, those publicly traded natural resource investments held by endowments participating in the NTSE had a –7 percent average one-year return, while commodities/futures reported a 2.2 percent loss, and private energy and mining fell 1 percent. Meanwhile, the venture capital asset class among participating endowments jumped 13.4 percent, while private equity increased 10.2 percent, and U.S. stocks gained 8.2 percent.

Table 3 also shows the strong correlation between nontraditional investments and endowment size. On average, investments in U.S. equities accounted for more than 45 percent of the assets within endowments of $25 million or below. In contrast, American stocks made up only 11.2 percent of the investments for endowments over $1 billion. Large endowments also had a larger share of their funds in private equities, venture capital, and private real estate, while smaller endowments were more likely to have larger shares of investments in U.S. bonds.

Spending Dollars Continue to Rise

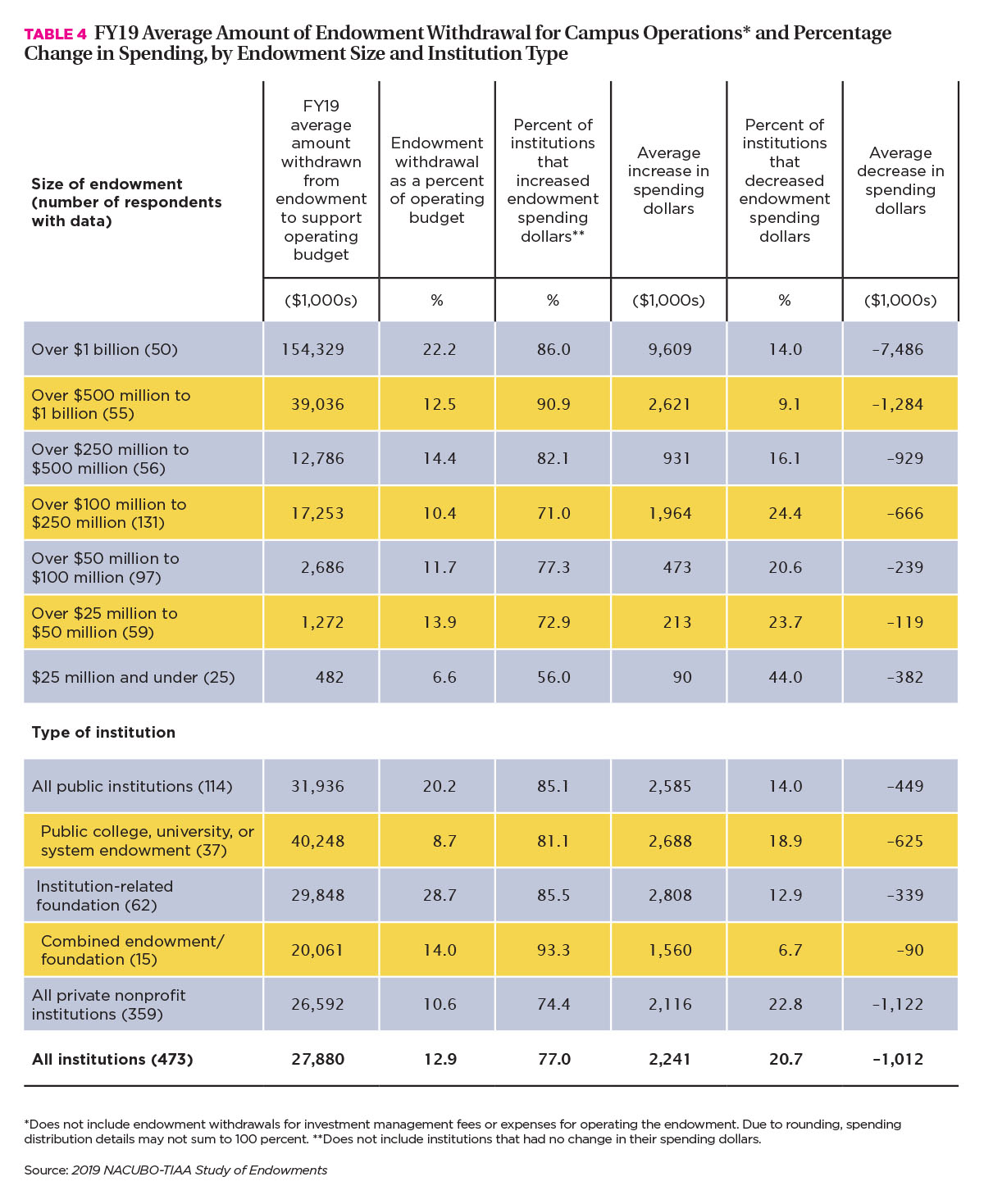

One major benefit of the increased long-term returns has been that most responding campuses were able to increase their endowment withdrawals substantially. More than three-quarters of NTSE participants increased the amount of funds spent from their endowments to support their institutions’ operating budgets in FY19 (not including amounts spent for external investment fees and other expenses for managing the endowment). Among those schools that increased endowment spending, the average increase was more than $2 million (Table 4). The largest endowments accounted for a significant share of the increase in overall spending dollars. On average, the overall endowment withdrawals from these schools increased by more than $9.6 million.

“These significant increases in spending from endowments demonstrate the commitment that colleges and universities have to student access and success,” Johnston says. “They are coming at a time when other sources of funding may be constrained. Endowment managers were clearly using the improved market returns to provide more assistance to students and their families, helping more students fulfill their college-attainment goals.”

On average, NTSE participants withdrew about $27.9 million from their endowments to support their campuses, accounting for nearly 13 percent of their operating budgets. Among schools with more than $1 billion in endowed assets, the average withdrawals supported 22.2 percent of their operating budgets. In contrast, about one-fifth of the survey participants reported a decline in their endowment spending dollars, with a median decrease of about $1 million. Generally, schools with smaller endowments were more likely to report reduced spending dollars than those with larger endowments.

Can These Results Continue?

The increases in long-term returns and endowment spending dollars have taken place during relatively strong economic conditions. These fortunate circumstances have continued into the first half of FY20. In the first six months of FY20, the S&P 500 rose 8.4 percent, according to Yahoo Finance. In this time span, investors were generally cheered by rising job growth and consumer spending, lower interest rates, and a partial cease-fire in the U.S.-China trade war.

Despite these gains, there is growing concern that these favorable economic factors may change. “The current expansion is pretty long in the tooth,” O’Leary points out. “We’re already seeing subtle signs of a change in direction.” A few of those signs of change were evident during the first half of the fiscal year. During the first two quarters of FY20, U.S. gross domestic product, a common gauge of economic growth, slowed substantially. In addition, consumer debt began to rise substantially, which may hinder future spending, and the Fed signaled that its rate-cutting campaign will end soon. Additionally, prospects of the COVID-19 virus spreading and other troubles overseas may trigger changes in financial conditions.

While American stocks remain strong, many investors are weary of sudden shifts in economic sentiment. “We are very concerned that any more negative changes in market conditions could make it even more difficult for endowments to generate the returns they need to meet their long-term targets and maintain intergenerational equity,” O’Leary says. “The new decade may be even more challenging than the one that just ended.”

These financial challenges are not the only headwinds facing higher education. “We must also deal with rising operating costs, slow growth in financial support from state governments, and falling enrollment,” Johnston says. “Endowments will remain a crucial source of support for many institutions, and any changes in financial conditions will undoubtedly affect our efforts.”

Institutional responses to the many challenges that lie ahead for endowments will of course vary by endowment size and many other factors. However, college and university leaders will undoubtedly remain focused on investing these funds in ways that both benefit today’s students and provide long-term growth for future generations.

KENNETH E. REDD is senior director, research and policy analysis for NACUBO.