For both public and independent colleges and universities, the last few years have included frequent and significant changes to accounting and reporting standards. This past year was no exception, as institutions implemented new Financial Accounting Standards Board (FASB) and Government Accounting Standards Board (GASB) requirements in FY19 and more on the horizon for FY20.

Looking Back

In FY19, independent institutions dealt with the most significant reporting change in over two decades, while public institutions continued to grapple with recognizing additional liabilities.

FASB’s Impact on Financial Statements and Processes

New Reporting Model. FASB’s Accounting Standards Update (ASU) 2016-14, Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities has been on the horizon for years and was finally implemented by all private colleges and universities in FY19. The ASU introduced a new format, additional disclosures, and reduced the number of net asset categories from three to two:

- Net assets without donor restrictions, which is a relabeling of the “unrestricted” category.

- Net assets with donor restrictions, which is a combination of temporarily and permanently restricted net assets.

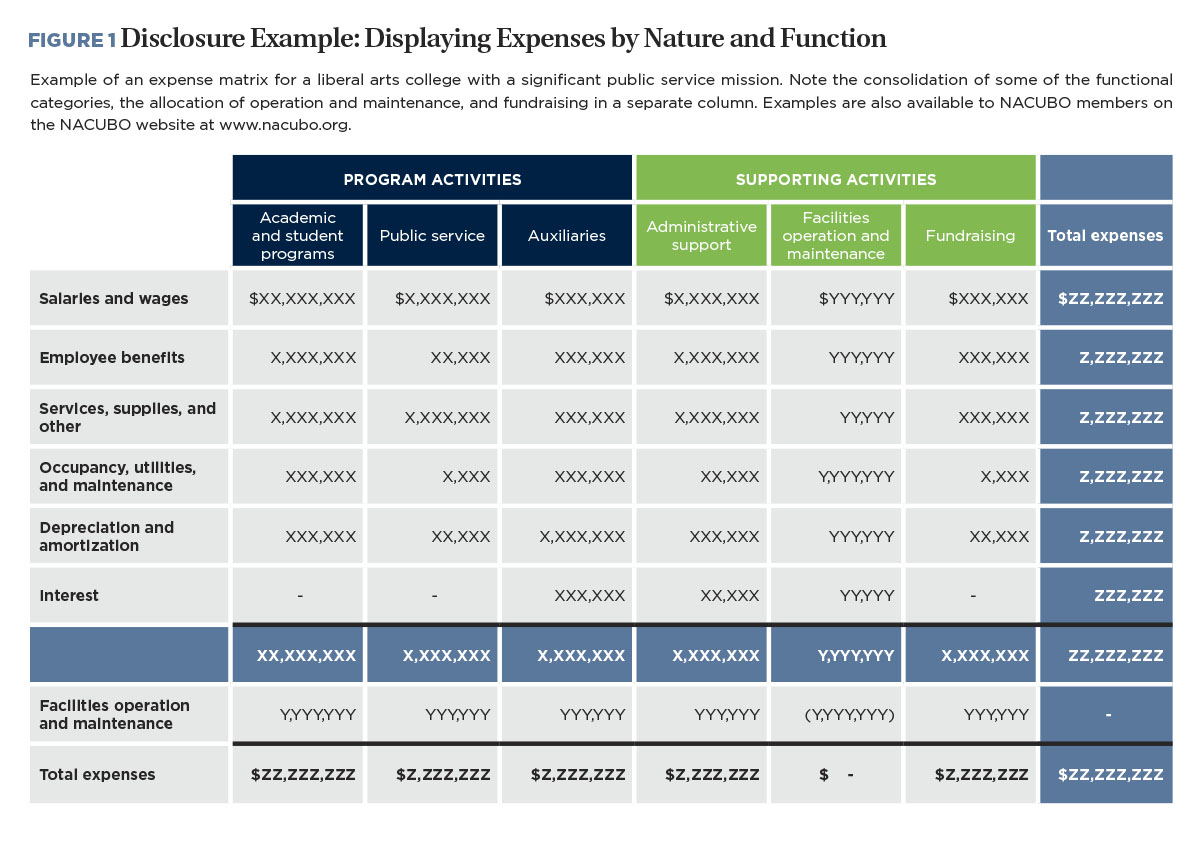

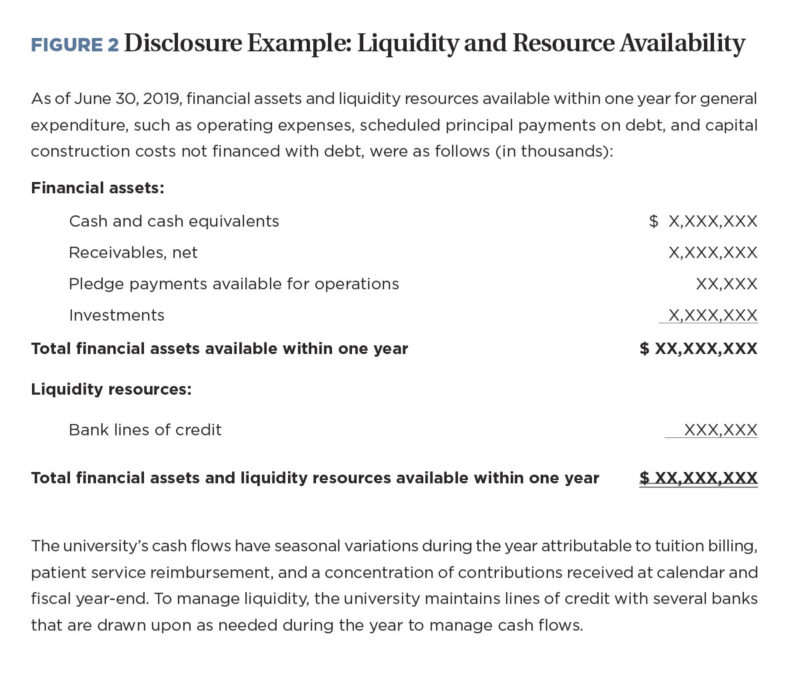

The ASU also changed the net asset category in which underwater endowments are reported (from unrestricted net assets to net assets with donor restrictions). New disclosures include qualitative information about liquidity, quantitative data on availability of resources, operating expenses reported by both natural and functional classifications, and details about governing board designations on net assets without donor restrictions.

On the plus side, FASB has introduced flexibility for colleges and universities to effectively tell their stories. Because the loss of certain information, with only two net asset classes, may make it challenging for lenders, analysts, and others to easily calculate key ratios and assess debt covenants or financial health, NACUBO’s Accounting Advisory encourages institutions to display or disclose the perpetual portion of net assets with donor restrictions (analogous to permanently restricted net assets) and to add “net investment in plant” as a component of net assets without donor restrictions. These important net asset details are needed to calculate the core financial ratios that comprise the composite financial index, as described in the book Strategic Financial Analysis for Higher Education, produced in partnership by Prager & Co. LLC, KPMG, and Attain. (See Figure 1 and Figure 2 below for a new expenses disclosure example and a liquidity and resource availability disclosure, respectively.)

Revenue Recognition. FASB’s issuance of ASU 2014-09, Revenue from Contracts with Customers (Topic 606) was a long-awaited and complex standard resulting from FASB’s convergence effort with the International Accounting Standards Board. As such, although the new standard was researched and issued with publicly traded companies in mind, it affects all entities that follow FASB guidance. ASU 2014-09 (and subsequent amendments) replaced industry-specific revenue recognition rules with principles-based guidance for entities that enter into contracts with customers for goods or services.

To implement the standard, institutions must apply five steps to contracts with students and other customers:

- Identify the contract(s) with a customer.

- Identify the performance obligations in the contract(s).

- Determine the transaction price.

- Allocate the transaction price among the performance obligations in the contract(s).

- Recognize revenue when (or as) the entity satisfies a performance obligation.

While independent institutions analyzed various revenue streams (tuition, residential services, hospitals and health care, sales and services, and other ad hoc revenues) and documented the analysis for auditors, most found that the new requirements had very little impact on their financial statements and disclosures. NACUBO issued three revenue recognition advisories to assist with interpretation and implementation: NACUBO Advisory 19-01 examined tuition as a proxy for student contracts with illustrative journal entries; NACUBO Advisory 19-02 addressed financial aid related to education and residential contracts and the importance of service distinction between the two; and NACUBO Advisory 19-03 discussed disclosures and provided examples.

Accounting for Conditional Contributions. The issuance of ASU 2014-09 shined a light on contracts that appeared to be exchange transactions for financial reporting, but in reality lacked the essential characteristic of an exchange: direct commensurate value to the resource provider (or customer) in exchange for consideration. For example, although sponsored research grant agreements advance knowledge in a particular academic field and result in an exchange-type revenue presentation on the financial statements, there typically is not a direct exchange between the sponsor and the college or university.

To address this “gap in the GAAP,” FASB issued ASU 2018-08 Not-For-Profit Entities (Topic 958): Clarifying the Scope and Accounting Guidance for Contributions Received and Contributions Made. The ASU clarified the difference between exchange (reciprocal) and nonexchange (nonreciprocal or contribution) transactions and improved existing guidance for identifying nonreciprocal conditions. A contribution is considered conditional if the agreement includes both a barrier that must be overcome in order to be entitled to the transferred resources and either a right-of-return of assets or a right-of-release of a promisor’s obligation to transfer assets.

As a result, federal grants subject to Uniform Guidance requirements are considered conditional contributions and revenue is recognized as barriers to entitlement are satisfied, usually when research milestones and grant agreements call for expense reimbursement. To comply with the ASU, institutions with significant research activities had to review and classify all active grants and contracts (as reciprocal or nonreciprocal, and subsequently within nonreciprocal as either conditional or unconditional). Additionally, because most government grants are conditional promises for funding over the grant period, disclosure requirements for conditional promises to give are applicable (FASB ASC 958-310-50-4). Consequently, in FY19 institutions with material grants in process had to disclose the total amount of conditional signed award agreements for research work that will be performed in the future. More information on ASU 2018-08 can be found in the Standards Spotlight section of the NACUBO Financial Accounting and Reporting Manual (FARM).

GASB’s Recognition of Institutional Liabilities

GASB continues to evaluate whether the breadth of governmental activities is represented in the financial statements of public institutions, prompting significant new standards that have improved or expanded recognition and measurement criteria.

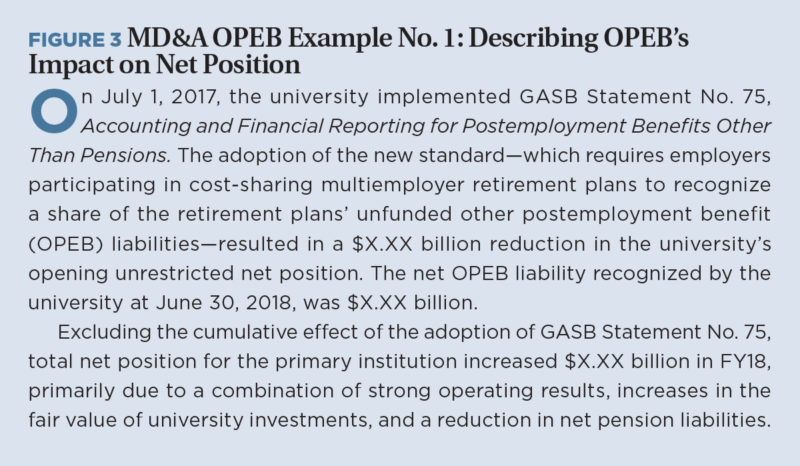

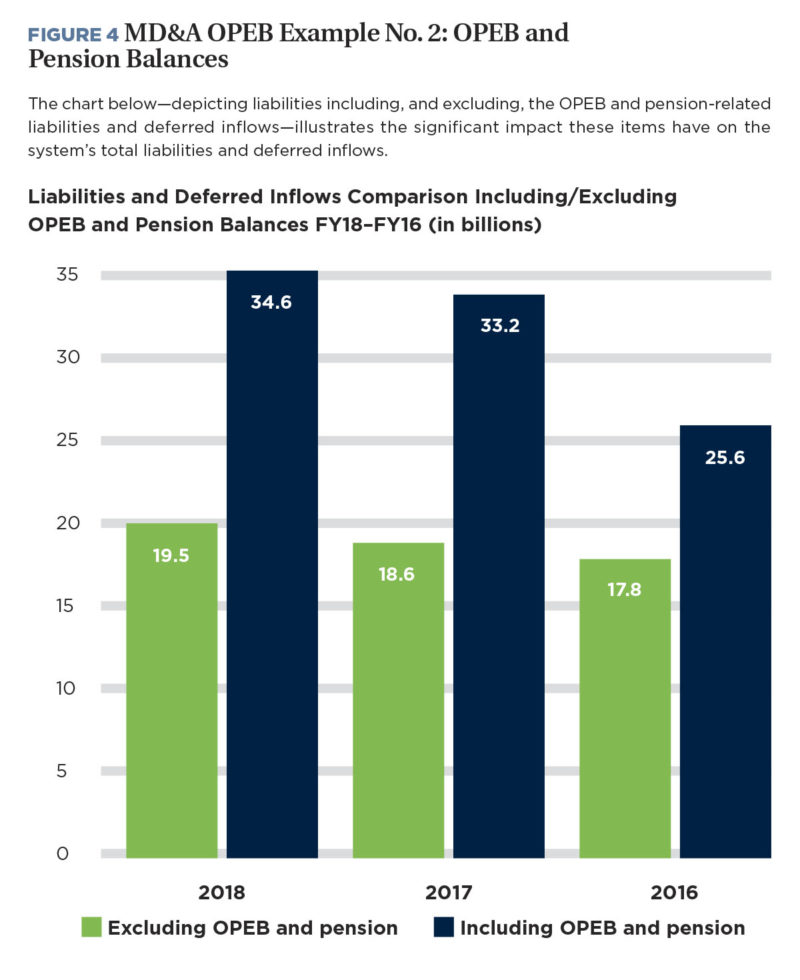

OPEB Liabilities. The most recent example of enhanced measurement was the implementation in FY18 financial statements of GASB Statement No. 75, Accounting and Financial Reporting for Postemployment Benefits Other Than Pensions. The liabilities for other postemployment benefits (OPEB) and defined benefit pension plans under GASB Statement No. 68 have caused significant reductions in the net position of public institutions. Many public institutions have used the Management’s Discussion and Analysis (MD&A) section to show the net position and results of operations without the additional liability for future benefits. (See Figure 3 and Figure 4 below for public institutions’ MD&A OPEB examples.)

Asset Retirement Obligations. For public institutions, GASB Statement No. 83, Certain Asset Retirement Obligations was effective for FY19. The statement required all governments to recognize a legally enforceable liability associated with the retirement of certain tangible capital assets. Typically, laws and regulations that address environmental sustainability require very specific activities when assets are retired. For example, decommissioning nuclear reactors, removing and disposing of wind turbines, dismantling and removing sewage treatment plants, or removing and disposing of X-ray machines have legally required disposal protocols that obligate a government for additional costs that must be estimated and recognized as a liability.

Implementing GASB Statement No. 83 required collaboration across many functions on campus: finance, risk management, environmental health and safety, and facilities. Dana Malone, assistant controller for the University of Texas System, shared that the most challenging aspect of this process was identifying key contacts who would have the inventory of assets that required decommissioning plans and the related estimated costs. Another challenge was that the amortization period of the estimated costs is linked to the useful life of the underlying assets, many of which were at the end of or beyond their estimated useful life—leading to an immediate recognition of estimated expenses as a charge to opening net position. Because information must be continually updated, Malone suggests that business officers regularly communicate with the offices that maintain the records.

More information on the accounting for asset retirement obligations can be found in the Standards Spotlight section of FARM.

Leases. Although GASB Statement No. 87, Leases, will be implemented in FY21 for most public institutions, those institutions that produce comparative financial statements will need to provide lease asset and liability information for FY19 because the MD&A requires that each reporting year be compared with the prior year. Comparative financials for FY21 have a base reporting year of FY20, which must be compared against FY19 results in the MD&A.

The new lease standard establishes a single model for lease accounting based on the principle that all leases are a means to finance a right-to-use asset. Lessees will recognize a lease liability and an intangible right-to-use asset. Lessors will recognize a lease receivable and a deferred inflow of resources. There is an exception for short-term leases with a maximum term of 12 months or less.

The accounting concepts for both lessees and lessors are fairly straightforward. Lessees record a lease liability for the present value of the future lease payments and a right-to-use asset equal to the lease liability (plus direct costs incurred by the lessee and payments made to the lessor before commencement of the lease, net of any lease incentives). The lessor records a lease receivable based on the present value of the anticipated lease payments and a deferred inflow of resources. The deferred inflow of resources is equal to the lease receivable (plus any payments received by the lessor prior to the commencement of the lease, net of any lease incentives).

The potential issues associated with implementing the new lease standards are operational, in that identifying and tracking all active leases may be a major undertaking. While procurement records are an ideal source for agreements in which the public institution is a lessee, many institutions are also lessors, for which the contracts may be more difficult to find. For universities with many leases, a software solution may be required to achieve efficient processes for calculating the initial assets and liabilities and generating the subsequent amortization entries. Collaboration across facilities, finance, legal, procurement, and auxiliary departments will be essential for all colleges and universities.

On the Horizon

For both independent and public institutions, the work isn’t over yet. Institutions that follow FASB are also sharing in the fun of new accounting and reporting requirements for leases. And, public institutions are deciphering the requirements of GASB Statement No. 84, Fiduciary Activities.

FASB

Leases. Although FASB has extended the implementation date for many of its new updates, the extension for the changes required by ASU 2016-02, Leases (Topic 842) did not apply to independent institutions with publicly traded or conduit debt. Therefore, the ASU is effective for the fiscal year beginning after Dec. 15, 2018 —i.e., FY20 for most institutions. This new standard replaced the four bright-line tests for classifying leases as either capital or operating with criteria that are conceptual and require interpretation and judgment.

All leases with a term of more than 12 months will create an asset and liability, although there is still a difference between a finance lease and an operating lease, with the different categories affecting how the transactions are reflected in the statement of activities and statement of cash flows.

For lessees, finance leases create a right-to-use asset and a lease liability. The effect on the statement of activities includes amortization of the right-to-use asset and interest expense on the lease liability. For operating leases, the annual rent expense recognized is constant throughout the term of the lease, similar to how operating leases were recorded in the past.

For lessors, the equivalents to a lessee’s finance lease is a “sales-type” lease or a direct financing lease. The concept of an operating lease is the same for the lessee and lessor. Again, the classification affects how the transaction is reported on the statement of activities and statement of cash flows.

Implementation challenges have included compiling an inventory of all existing leases and choosing and implementing software to track and perform the calculations. More information can be found in the Standards Spotlight section of FARM.

GASB

Fiduciary funds. Public institutions are working through the issues related to GASB Statement No. 84, Fiduciary Activities, which is effective for the current fiscal year—i.e., FY20. The statement requires a separate set of Fiduciary Fund financial statements—a Statement of Fiduciary Net Position and a Statement of Changes in Fiduciary Net Position—when the fiduciary funds held by a public institution are material.

There are four types of fiduciary funds:

- Pension or OPEB plans that are administered through a qualifying trust as specified in Paragraph 3of GASB Statement No. 67 and GASB Statement No. 74, or an equivalent arrangement.

- Investment trust funds that meet certain criteria.

- Private-purpose trust funds (non-Pension, non-OPEB, or noninvestment).

- Custodial funds.

The statement establishes in only 28 paragraphs the criteria for identifying fiduciary activities and specifies how those activities are accounted for and reported in financial statements. Due to its brevity and basic concepts within the statement, and because the fiduciary funds held by most public institutions are not material, this statement has been a real “sleeper” for NACUBO members.

However, following GASB’s issuance of its implementation guide on fiduciary activities (2019-02), issues have surfaced concerning the definition of a component unit and whether defined contribution plans are pension component units and therefore fiduciary funds for financial reporting. NACUBO staff, the NACUBO Accounting Principles Council (APC), and representatives on the Governmental Accounting Standards Advisory Council have asked GASB staff and members for clarification. The APC will be attending a meeting with GASB in Norwalk, Conn., to address this topic. Meanwhile, NACUBO’s work with GASB staff throughout fall 2019 clarified the meaning of questions and answers 4.1 through 4.5 in the fiduciary activities implementation guide. NACUBO Advisory 20-01 addresses GASB’s intent and interprets those questions and answers for colleges and universities.

Are We “There” Yet?

Both standards-setting boards publicize their future research projects and project plans on their websites. For independent institutions, FASB is currently working on an in-kind contribution project that is expected to minimally impact higher education. However, the project with the most potential to affect not-for-profit colleges and universities—whether to require a measure of operations for financial reporting and how to define it—has been placed on the back burner by FASB and does not have a publicized timeline.

For public institutions, NACUBO is monitoring what GASB calls “the Big Three”—those projects addressing the financial reporting model, revenue and expense recognition, and the disclosure framework. For the first two projects, NACUBO’s comments in response to GASB’s Preliminary Views (PV) and Invitation to Comment, respectively, are available on its website. An Exposure Draft (ED) for the financial reporting model and a PV for revenue and expense recognition are expected to be released by early July. GASB also plans to issue an ED on the disclosure framework in early April. NACUBO will monitor the discussions of both standards-setting boards and will continue to advocate on behalf of its members.

SUE MENDITTO is senior director, accounting policy, NACUBO, and MARY WHEELER is author of the NACUBO Financial Accounting and Reporting Manual.