Most college and university endowment managers face the same set of core challenges: how to enhance financial returns, lower investment risk, and deliver increased cash flow to ensure adequate support of operating and capital budgets. How can your endowment consistently achieve all three and positively engage students and alumni in your endowment process?

As a president, chief financial officer, or member of the senior management team at five academic institutions during the past 35 years, I have experienced these pressures firsthand. Over this same time period, I have also observed in many board and committee meetings that efforts to discover, adopt, and implement new investment policies are often constrained by time as well as tradition.

In short, it can be difficult to make sweeping changes to institution investment policy quickly. And yet, in the space of less than two years from idea to implementation, the investment committee and full board of Becker College, Worcester, Mass., have incorporated an “all in,” 100 percent, social impact goal of measurable criteria for sustainable, responsible, impactful (SRI) investing for our college endowment—what we call “impactful investing.”

Indeed, more college and university endowments are adopting environmental, social, and governance (ESG) criteria as part of their investment strategy. And, a growing number of institutions are likewise divesting from coal, oil, and gas investments as part of the fossil fuel–free movement—precipitated in large part by students petitioning trustees to invest in more environmentally and socially conscious ways.

But while hundreds of billions of dollars are currently invested by U.S. higher education endowments, very few boards of trustees to date have sought to fully align their endowments with their institution mission. To our knowledge, Becker College is the first to specify that 100 percent of its investments should produce measurable positive “social impact”—to include metrics on health, income equality, environment, diversity, and transparency.

Mission Critical

Becker is a private, undergraduate and graduate, career-focused college. Its 2,000 students are pursuing degrees in technology and game design, nursing and health care, and animal science for food systems. It makes sense that our investment portfolio can benefit from innovations in technology, health care, and agriculture. Likewise, sustainability maintains an important focus throughout curricular and co-curricular programs at Becker. With major animal science, pre-veterinary, and biology programs, the college attracts students who come with expectations that sustainability is a priority value.

Social business and community service are additional threads that prospective and current students expect to find in the Becker DNA. As our President Nancy P. Crimmin asserts: “Our students today come to us with very different expectations than in years past. Higher education must provide them with opportunities that present real-world issues for them, through engagement on activities and issues focused on social responsibility, sustainability, community service, and more.”

And, with the launch in 2015 of the Yunus Social Business Center at Becker College—affiliated with Nobel Peace Prize winner Muhammad Yunus—the opportunity for a 100 percent, social impact endowment seemed a natural next step. Yet, to accomplish this meaningful journey has challenged the norms and expectations of our investment policy, our process, and our partners.

This case study shares the lessons learned and insights gained from our experience in order to inspire more higher education presidents, board members, chief business officers, investment professionals, and investment advisers and endowment consultants to consider the potential of positive, impactful investment for their institutions.

Impactful Insights

As fiduciary leaders of our institutions, we all do well to look forward, rather than backward, with regard to potential risks and returns and the impact of our investments and the policies associated with them. We also benefit from questioning how we can approach endowment investment in a way that taps alumni excitement and student passion for building a better world, in line with our institution’s mission.

Three key insights have emerged from our experience at Becker College, as we have transitioned to impactful investing.

Insight 1: Incorporating impactful (SRI + ESG) criteria into investment policy and decision making can lower future risk and strengthen endowment return potential. “Past performance is not indicative of future results.” We all know this mantra by heart, but many boards and investment committees continue to focus more on recent performance than on considering future risks.

With solid research and performance history now available, and with big-brand financial institutions now embracing SRI and ESG investment strategies, endowment portfolios have greater potential for achieving higher financial returns (often above their benchmarks), at lower financial volatility and risk, while maintaining alignment with the mission of the institution. At Becker, we chose a comprehensive approach to our SRI investing called HIP (Human Impact + Profit) investing, which measures impact quantitatively and demonstrates direct links to leading indicators of future cash flow, profit, and financial returns. (See sidebar, “The HIP Approach.”)

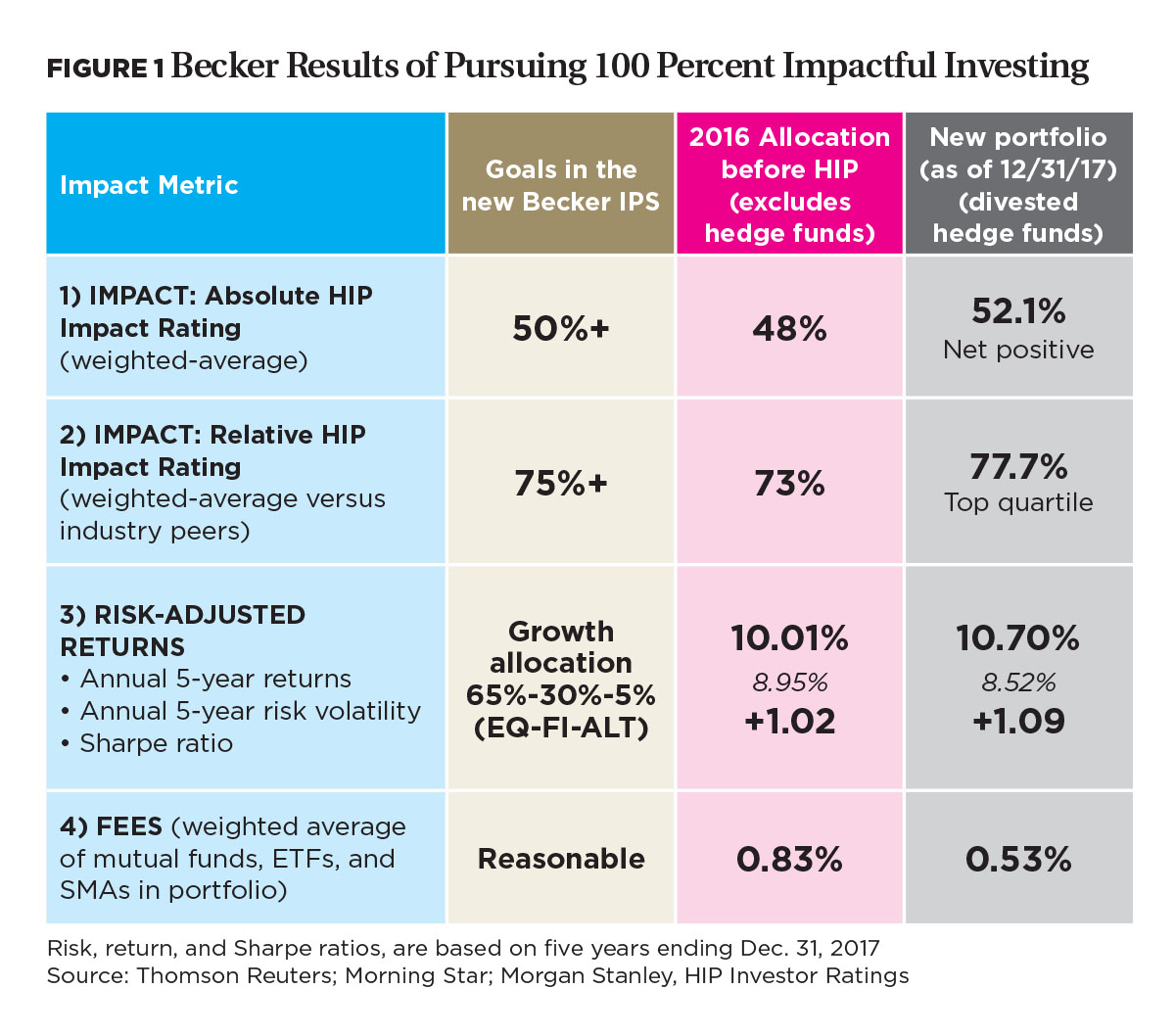

To accomplish this, we evaluated all holdings inside our portfolio of equities, fixed income, alternatives, and hedge funds based on their net positive impacts on, and net negative risks to, society. By shifting our portfolio toward more net positive investments and funds—and away from net negative holdings that can increase future risk—we have improved the financial results of Becker’s endowment and dropped our investment fees. (See Figure 1, “Becker Results of Pursuing 100 Percent Impactful Investing.”)

Insight 2: Investing endowments for impact and sustainability is a meaningful way to engage the whole board and enhance the investment committee’s links to the mission of the institution. Across the spectrum of higher education, Becker is relatively young as an endowment. Starting with $1.5 million in 2009, our current total has grown to $5 million from investing, targeted fundraising, and operational surpluses.

Another factor has been the treatment of many temporarily restricted gifts. For example, in past years when a donor wished to help student scholarships with $25,000, the priority was to help students and families directly, versus drawing 2.5 percent from an endowed gift. In many cases, the donor desire was to help immediately, and a gift of this size might have been divided into five $5,000 scholarship awards. As a career-focused teaching college, the priority was to help students graduate versus a focus on building the endowment.

Finally, prior to fall 2015, Becker’s investment policy would have been viewed through a very traditional asset allocation lens. Working with our investment adviser, our objectives were to ensure liquidity, the preservation of purchasing power after spending, and long-term capital growth. Our asset allocation was set at 55 percent equity, 15 percent fixed income, and 30 percent alternatives.

With our new focus on impactful investing, members of Becker’s board and the investment subcommittee began to discuss ESG as a set of standards to screen investment options. Specifically:

- Environmental criteria examine how a company performs as a steward of the natural environment.

- Social criteria look at how a company manages relationships with its employees, suppliers, customers, and local communities.

- Governance criteria deal with the company’s leadership, executive pay, audits, internal controls, and even shareholder rights.

In combination with Becker’s academic programs, several threads began to come together for us around the central themes of social and financial responsibility. At our October 2015 investment committee meeting, we had a long discussion about the HIP methodology. A HIP Investor team provided Becker with an analysis of rating future risk, return potential, and the net impact of the endowment.

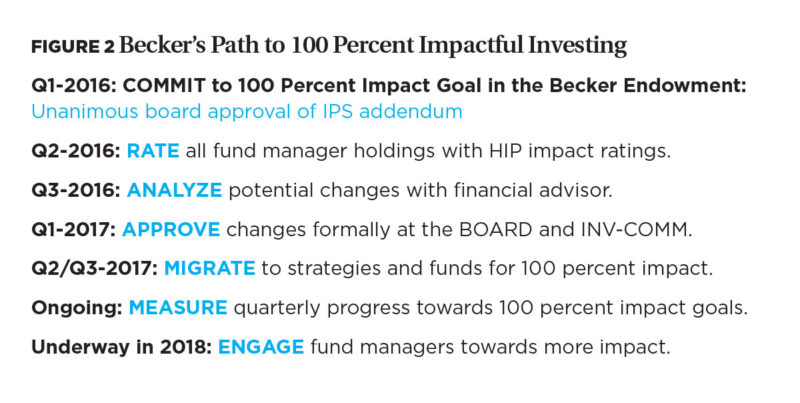

After three months of researching, reading, and coming up to speed with the latest evidence, the Becker investment committee expressed deep questions on the process, criteria, and decision making required to make a bold move into impactful investing. With confidence that the HIP approach was fundamental and systematic, the investment committee recommended to the full board a resolution to “authorize the Investment Committee to work with appropriate internal and external resources to examine all aspects of adding the HIP (Human Impact + Profit) investment philosophy/approach as an addendum to the Becker Investment Policy.”

Later that month, during our full board meeting in October 2015, Becker’s trustees unanimously approved an addendum to the investment policy statement. We resolved that by Dec. 31, 2016, 100 percent of Becker’s investment portfolio was to produce a positive social impact and HIP rating of no less than 50 percent. Doing so would equate to a “net positive” portfolio of stocks, bonds, alternatives, and funds.

During the course of 2016, considerable discussion began to examine ways to transition Becker’s portfolio. There was some skepticism with members of the administration and board regarding the primary hurdles to overcome in this change process. Under the mantra of “do no harm,” the relatively new impact and sustainability concepts were a shift for those of us graduating with MBAs 25 years ago, as well as for volunteer not-for-profit board members familiar with impact in their programs, but not yet in their endowments. Yet, as more data became available, we started shifting the portfolio, starting with transitions out of two hedge funds, liquidating other securities, and stockpiling a cash pool with which to strategically invest with the HIP system.

At the January 2017 investment committee meeting, HIP Investor Chief Executive Officer R. Paul Herman and his team, in collaboration with our investment advisers, reviewed the impact ratings of the current portfolio. Their recommendations included shifts to investment funds producing “higher impact” with lower future risk and higher expected returns, and ways that our investment adviser’s platform could help reduce expense ratios with separate account managers with lower fees. The material reviewed by the committee was a detailed analysis of which funds and managers to keep and which to change with various asset classes. The committee voted unanimously to accept the joint recommendations of HIP Investor and our investment adviser.

With Becker’s board voting to commit to 100 percent impactful investing, our asset allocation required adjustment to take maximum advantage of the HIP system. As of January 2017, our new asset allocation is as follows: 63 percent equity, 29 percent fixed income, 6 percent alternatives, and 2 percent cash.

As of July 1, 2017, the Becker investment portfolio completely shifted to 100 percent pursuit of impactful investing. Among the facets of this change process that came clearly into focus for the college: The pro-impact, or HIP approach, provides a proactive opportunity to address social issues and meld them with endowment management to enable both fiduciary and societal responsibility.

Insight 3: Implementing an intentional endowment investment policy is achievable and can be accomplished in a relatively short time frame, but it requires methodical leadership. To accomplish this swift timeline of portfolio turnover requires leadership driven by a willingness to explore new ideas, test old assumptions (especially in finance), and include new research and partners in the process. Traditional finance assumptions can sometimes constrain us, as they tend to focus on costs of labor instead of people as an asset, or to consider natural resources like water as free or cheap instead of appropriately priced for its full value to society and nature. Likewise, even as we trust the counsel of our mutual fund managers, we must remain mindful that they, too, need to better understand this new movement toward impactful investing, which can benefit their own bottom lines.

The good news is that college and university board and investment committee members, presidents, CBOs, and other senior managers can discover, design, and implement a more intentionally positive and impactful portfolio to benefit long-term endowment performance. This activity can also more deeply engage your current student body and alumni, which in turn could boost the potential for donations related to impact, including multiyear grants and funding for new programmatic priorities.

As academics and administrators, we need to embrace and foster new ideas, tap into the rich research in our programs within higher education to better understand the trends, and discover how new technologies can blend into society and drive the financial performance of our future-looking portfolios. In fact, our endowments require this to survive future challenges and advance overall innovation to solve human, social, and environmental problems. While our time as chief business and chief financial officers is scarce and filled with multiple priorities, our diligence is required for fulfilling our fiduciary duty. With the emergence of impactful investing, we can advance our endowments and academic missions in tandem.

DAVID A. ELLIS is executive vice president and chief financial officer of Becker College, Worcester, Mass.

Read also “Investing With a Purpose” and “A Cooperative Path Toward Divestment.”