When it comes to the Financial Accounting Standards Board (FASB), there is always something happening that impacts private colleges and universities. Even in years where no new standards have been issued, there are ongoing efforts to monitor recently issued standards that will soon be effective. Such was the case in 2017. While institutions followed FASB’s project on accounting for grants and contributions, they also prepared to implement two recently issued Accounting Standards Updates: revenue recognition (2014–09) and not-for-profit financial statements (2016–14).

Rethinking Revenue

Revenue recognition was at the top of the Financial Accounting Standards Board’s agenda for not-for-profit organizations in 2017. When FASB issued Accounting Standards Update (ASU) 2014–09—Revenue from Contracts with Customers (Topic 606) (ASC 606)—significant portions of the existing revenue recognition guidance for not-for-profit entities (NFPs) were eliminated. In particular, the term “exchange transaction” has been eliminated, leaving NFPs with only two options for revenue recognition: contribution or contract with a customer.

Recognizing that the elimination created a gap in the accounting literature, FASB added a project to its agenda in April 2016 in an effort to address this issue. The project applies to all grants (and other contributions) received that do not meet the definition of a contract with a customer, regardless of the type of grantor/donor or the type of grant/giving arrangement. In August 2017, FASB issued a proposed Accounting Standards Update (ASU) Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made. A summary of the main tenets of the proposal and NACUBO’s feedback to FASB follow.

Contribution versus exchange transaction. The proposed ASU provided two key considerations to assist in determining whether a grantor is receiving commensurate value in return for resources transferred to an NFP and, as such, whether a transaction is a contribution (nonreciprocal) or a contract with a customer (reciprocal or exchange). Those considerations are:

1. An indirect benefit received by the public as a result of the assets transferred to an NFP is not equivalent to commensurate value received by the resource provider.

Financial Statements of Not-for-Profit Entities:

Department of Education Financial Responsibility Requirements

FASB ASU 2016–14 requires changes in the following areas throughout the financial statements:

- Net assets.

- Underwater endowments.

- Expiration of capital restrictions.

- Reporting of expenses.

- Investment expenses.

- Operating measure requirements (if the institution chooses to present such a measure).

- Statement of cash flows presentation.

- Liquidity and availability of resources.

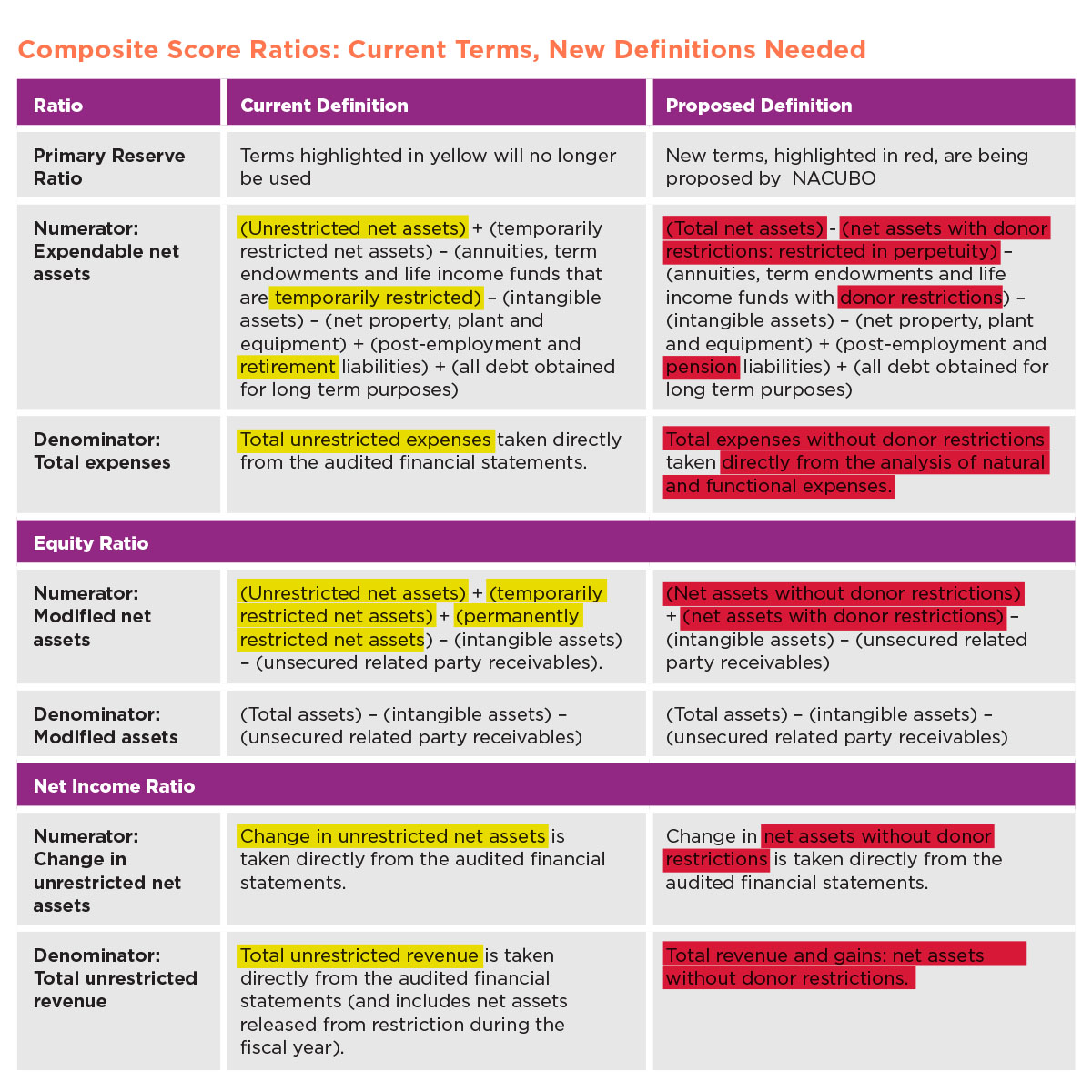

The significant changes that will directly impact financial responsibility ratios are changes to net assets and underwater endowments. The terminology changes alone upend the current formulas used in calculating composite scores for nonprofit institutions; as a result, negotiations with the Department of Education have been taking place since November. The table illustrates the formula and terminology changes recommended by NACUBO.

2. Execution of a resource provider’s mission or the positive sentiment from acting as a donor does not constitute commensurate value.

NACUBO agreed with FASB that these considerations would be helpful in determining whether a transaction was a contribution or a contract with a customer. Since the vast majority of higher education’s sponsored research grants are aimed at advancing knowledge for academic or public benefit—and because universities typically retain the rights to the research results in these cases—sponsored research grants would typically be considered nonreciprocal. Nonreciprocal transactions are not exchange transactions and are therefore a type of contribution.

The ASU also highlighted certain transactions that would be outside the scope of the guidance, such as payments from third parties on behalf of existing exchange transactions. The ASU cited the Pell Grant program as an example of such transactions. Because the proposed guidance went on to say that these types of transactions should be accounted for in accordance with other guidance such as ASC 606, NACUBO commented that readers might be misled into thinking that Pell Grants should be treated as exchange transactions. Consequently, NACUBO requested that the Pell Grant reference be eliminated as independent institutions treat Pell Grants as agency transactions, which are neither contributions nor exchange transactions.

Conditional versus unconditional contributions. If a transaction is determined to be a contribution, the ASU attempted to refine the current guidance for assessing whether a contribution is conditional or unconditional. Specifically, for a contribution to be considered conditional, it must contain both of the following:

1. Either a right of return of assets transferred or a right of release of a promisor’s obligation to transfer assets, and

2. A barrier that must be overcome before the recipient is entitled to the assets transferred or promised.

The guidance proposed indicators to be considered when assessing whether a barrier exists and included examples to assist in making that determination. The proposed indicators are:

- The NFP is required to achieve a measurable outcome (e.g., provide a specified level of service, produce an identified number of units, or obtain a specific outcome).

- The agreement contains stipulations related to the primary purpose of the asset transfer. This excludes trivial or administrative requirements.

- The NFP has limited discretion over how the resources are spent.

- The NFP is required to take significant additional actions that it otherwise would not have taken.

NACUBO agreed with the proposed criteria for determining whether a contribution should be considered conditional, but found the last two indicators to be problematic and focused its feedback primarily on those.

Limited discretion by the recipient. As written, it is difficult to discern how this indicator differs from a restriction—particularly when the term “restricted” is used as part of the explanation. NACUBO recommended that the description clearly distinguish between a condition and a restriction as it applies to limited discretion and suggested the following: “The recipient has limited discretion over how the transferred assets may be spent. For example, the funds must be spent only on qualifying expenses or in accordance with a detailed line-item budget from which the recipient cannot deviate without approval from the funder. Limited discretion imposes conditions on the manner in which the funds may be spent. Consequently, limited discretion is different than a stipulation by the donor that restricts the purpose for which the funds may be spent.”

Also of concern was the guidance related to budgets as indicators of a barrier. In some cases, the proposed guidance seemed to indicate that the existence of a budget subject to approval by the grantor for significant deviations would be considered a barrier that must be overcome in order for the NFP to be entitled to the funds, while in other cases it was not considered a barrier. As a result, NACUBO requested that FASB clarify the guidance related to budgets as indicators of a barrier.

Unwinding Perkins Loan Program Activity

The Federal Perkins Loan Program, which provides low-interest loans to graduate and undergraduate students with exceptional financial need, expired Sept. 30, 2017. The program faced a similar threat in 2015 but was extended for two years.

Under the terms of the 2015 Extension Act, schools could make new Perkins Loans to graduate students through Sept. 30, 2016. For undergraduate students, new loans could be made through Sept. 30, 2017. On Oct. 6, 2017, the Department of Education (ED) issued a “Dear Colleague” letter, which provides information on the winding down of the Perkins program. The letter states that schools will need to return ED’s share of the institutions’ Perkins Loan Revolving Fund. Since institutions may make subsequent disbursements to eligible borrowers through June 30, 2018, ED will begin collecting its share following the submission of a school’s 2019–20 Fiscal Operations and Application to Participate (FISAP), which is due Oct. 1, 2018.

Program Choices

Institutions may choose to assign Perkins Loans to ED or continue to service the loans themselves. However, when loans are assigned, ED keeps all monies collected and does not reimburse the institutional share. If, on the other hand, an institution continues operating the program and remits excess cash annually, the institution can keep its share and repurpose the funds. Institutions may choose to assign the balance of their Perkins Loans at any time. Therefore, it may be cost beneficial to continue servicing the loans for a period of time, and, at a future date, assign the remaining amount to ED.

Decision Factors

While there is a chance that the program could be reinstated—either as an extension bill or during reauthorization of the Higher Education Act—institutions should begin planning for its unwinding. The following considerations may help in determining whether to assign the loans to ED or continue servicing them.

- Determine the value of the institutional portion of the loan portfolio. This amount would be forfeited if the loans are assigned to ED.

- Estimate the expected maturity of the current portfolio. This can be difficult to determine with precision because of deferment opportunities, but using the scheduled maturities and your historical average turn of the portfolio can help in creating an accurate estimate.

- Estimate the costs of continuing to service the portfolio in-house over the estimated maturity (or per year). Include in the estimate any third-party servicer fees and internal staff costs to monitor the program, prepare/review/submit the FISAP, and so forth.

- Because assignment of the portfolio will result in a one-time charge to bad debt expense for the institutional portion of the portfolio, consider the impact of that on the institution’s financial results.

Additional actions. The examples included in the ASU related to this indicator of a barrier appeared to hinge on whether or not the funds received had been solicited by the NFP. This distinction is troublesome and NACUBO commented that solicitation of funds by a recipient should not be an indicator of a barrier. We noted, however, that if FASB concluded that solicitation is generally an indication of a barrier, that concept should be included in the discussion of barrier indicators. Overall, this indicator seemed to be too broad to be beneficial in determining whether a barrier exists. NACUBO recommended that if parameters could not be added to narrow the focus, the indicator should be removed.

NACUBO also suggested that the final ASU include examples of situations in which there may be multiple barriers. For example, a common situation in higher education is that of a grant which includes a cost sharing component (in addition to a qualifying expense requirement). In its comments to the board, NACUBO noted that a question had been raised about whether cost sharing is similar in nature to a matching grant, and, therefore, could impact the timing of revenue recognition. We stressed that in making that determination the recipient should look to the terms of the award to determine whether the cost sharing constitutes a barrier to entitlement of the funds provided by the grantor. To assist FASB in its deliberations on this topic, NACUBO provided some examples illustrating what should be considered when assessing whether grants with cost sharing arrangements are indicative of a barrier and how that assessment may impact the timing of revenue recognition.

Transition and Effective Date

The ASU proposed a modified prospective approach to application of the new standard. This would require institutions to apply the new guidance to agreements for which revenue had not been fully recognized as of the effective date and for agreements entered into after the effective date. NACUBO noted that under such an approach, an entity would still have to go through all of its grants, gifts, and pledges—which could be in the thousands—to determine the appropriate accounting going forward. Therefore, we recommended that FASB consider prospective application. Under that approach, an entity would need to assess only agreements entered into after the effective date, while allowing for current accounting of existing agreements to be maintained over the remaining term of the agreements.

As proposed, the guidance would have the same effective dates as ASC 606. For public entities (including NFPs that are conduit bond obligors or that have other publicly traded debt), the guidance would be effective for fiscal years beginning after Dec. 15, 2017 (FY19 for most colleges and universities). Nonpublic entities would apply the guidance for fiscal years beginning after Dec. 15, 2018 (FY20).

In its comments to FASB, NACUBO noted that institutions with significant numbers of grants and contributions may require certain system and process redesigns that could be labor intensive and time-consuming. We therefore recommended that the effective date for all not-for-profit entities (public and nonpublic) be for fiscal years beginning after Dec. 15, 2018, with early adoption allowed.

Next Steps

FASB received 56 comment letters in response to the proposed ASU. Feedback was generally supportive of the proposed guidance, although many respondents felt that further refinement and additions to the guidance would be necessary to achieve consistency in application. A summary of the comments was provided to the board at its Dec. 13, 2017, meeting. FASB will begin to consider the feedback received in early 2018, and a final standard is expected to be issued in the second quarter of 2018.

Revenue from Contracts with Customers

As previously mentioned, ASC 606—Revenue from Contracts with Customers, is effective in FY19 for institutions that are conduit bond obligors or have other publicly traded debt. Overall, the new guidance is not expected to have a significant impact on higher education institutions. However, institutions will need to pay attention to accounting for their fee for service (exchange) revenue—for example tuition, fees, and housing and dining services—because the analysis and terminology supporting the timing, measurement, and reporting display of revenue will change under the new standards.

Consider tuition revenue. To assess revenue recognition, ASC 606 requires the following:

Step 1. Identify the contract(s) with a customer.

Step 2. Identify the performance obligations in the contract.

NACUBO requested that FASB clarify the guidance related to budgets as indicators of a barrier.

Step 3. Determine the transaction price.

Step 4. Allocate the transaction price to the performance obligations in the contract.

Step 5. Recognize revenue when (or as) the entity satisfies a performance obligation.

Step 1. Institutions should first determine whether a contract with a student exists. ASC 606 requires all of the following criteria to be met in order for a contract to exist:

a. The parties have approved the contract and are committed to perform their respective obligations.

b. The entity can identify each party’s rights regarding the goods or services to be transferred.

c. The entity can identify the payment terms for the goods or services to be transferred.

d. The contract has commercial substance (that is, the risk, timing, or amount of the entity’s future cash flows is expected to change as a result of the contract).

e. It is probable that the entity will collect the consideration to which it will be entitled.

FASB will begin to consider the feedback received in early 2018, and a final standard is expected to be issued in the second quarter of 2018.

Generally, when an institution receives a nonrefundable deposit from a student to secure his or her spot for enrollment or housing, criterion (a) above has been satisfied. As a rule, criteria (b) and (c) are also fulfilled when the institution communicates enrollment expectations and payment schedules to students. Similarly, criteria (d) and (e) apply, because student consideration for instruction is an exchange transaction with commercial value, and the institution expects to receive payments based on experience.

Step 2. Upon determination that a contract with a student exists, institutions identify the performance obligations in the contract. Concerning tuition, the performance obligation is that of teaching a student throughout the stated academic term in the contract.

When student payments are received before performance obligations are satisfied, a contract liability is recorded (in essence “deferred revenue”).

Step 3. The transaction price for tuition is determined based upon the gross tuition charged and the amount of institutional aid provided. Institutional aid directly reduces tuition revenue (the transaction price) and eliminates the presentation of a discount for financial reporting. Also related to the transaction price are adjustments for variable consideration.

Most institutions have refund policies that allow students to drop courses and receive a full or partial refund in the first few weeks of a term. Student payments received that are subject to refund policies are considered a form of variable consideration. Since withdrawal refunds are typically not material for most institutions, the contract liability (deferred revenue) includes estimates of student withdrawal refunds. If partial performance on the contract has occurred, tuition revenue is reduced by estimates of student withdrawal refunds. If the amount expected to be refunded is material, a separate refund liability should be recognized.

Student receivables are not recognized (for the financial reporting period) until the institution is entitled to receive consideration from students (based on refund policies). Uncollectable receivables continue to be adjusted through establishing an allowance for doubtful accounts and recognizing bad-debt expense.

It will likely be impractical for institutions to estimate the refunds and account collections on a per student basis. Fortunately, the standard includes a practical expedient that allows the guidance to be applied to a portfolio of contracts with similar characteristics. When accounting for a portfolio, an institution would use estimates and assumptions that reflect the size and composition of the portfolio.

Steps 4 and 5. Concerning these final requirements, if the contract term falls within an institution’s fiscal year, it may not be necessary to make significant changes to current processes. For example, recording and relieving a refund liability within a few weeks during the fiscal year may be unnecessary, as it will not impact the institution’s financial reporting. Similarly, if amounts are immaterial, institutions should consider whether all amounts require recording. Institutions should be prepared to provide evidence of their analysis to their external auditors. Finally, institutions that prepare interim financial statements, have education sessions that span fiscal years, or have frequent academic terms that begin and end over short intervals, should carefully assess the impact that the new guidance may have on their financial reporting.

NACUBO is working to create a comprehensive example of accounting for tuition, fees, and housing and dining services that will incorporate the guidance in ASC 606. In addition, a session discussing implementation issues related to ASC 606 will be held at the Higher Education Accounting Forum, April 15–17, in Kansas City.

NACUBO Advisory Guidance and Advocacy Efforts

Independent institutions will beimplementing ASU 2016–14, the new FASB not-for-profit reporting model, for FY19. Some institutions adopted early, applying the new requirements in their FY17 financial statements. In FY18 it is likely that many more institutions will increase the early adoption numbers beyond the handful from 2017.

NACUBO is working to create a comprehensive example of accounting for tuition, fees, and housing and dining services that will incorporate the guidance in ASC 606.

A January 31 NACUBO webcast addressed the implementation of ASU 2016–14, with suggested examples from NACUBO’s implementation guidance. Although NACUBO has extensively covered this major change in NFP Reporting through news, professional development events, the Financial Accounting and Reporting Manual (FARM), and articles—federal agencies are lagging in their response.

While everyone will have transitioned to the new format by FY19, the National Council on Education Statistics (NCES), sponsor of the Integrated Postsecondary Education Data System (IPEDS) finance survey, does not anticipate changing the survey until the year 2020, at the earliest. Therefore, institutions will have to translate from the new reporting model to the current IPEDS survey, until the IPEDS survey is changed.

NACUBO staff have worked with IPEDS staff to map the current finance survey to the new format. NACUBO’s FARM, Appendix G, explains the differences between the new reporting model and the current IPEDS data survey, and provides a crosswalk as an aid to independent institutions to complete the survey from audited financial statements prepared using the new format.

NACUBO continues to study the new and proposed standards and will be providing industry guidance and best practice recommendations on an ongoing basis.

KAREN CRAIG is accounting project consultant for NACUBO; SUE MENDITTO is director, accounting policy, NACUBO.