Within the past decade, renewable energy has doubled its contribution as a percentage of overall power generation in the United States—from 9 percent in 2008 to 18 percent in 2017. According to the Business Council for Sustainable Energy’s 2018 Sustainable Energy in America Factbook published by Bloomberg New Energy Finance (BNEF), U.S. wind and solar capacity has increased more than 471 percent since 2008, from 25 gigawatts (GW) to 143 GW.

Globally, of the projected $10.2 trillion to be invested worldwide on new power generation between now and 2040, 72 percent will be spent on new wind and solar photovoltaic plants, according to BNEF’s New Energy Outlook 2017. By 2040, onshore wind costs are projected to fall 47 percent, while offshore costs will plummet 71 percent—much of this resulting from greater efficiency of turbines, competition, experience, and economies of scale, according to the report. Furthermore, utility-scale batteries will increasingly compete with or replace the role of natural gas in providing system flexibility during peak demand, and electric vehicle charging will likewise play a role in enhancing the efficiency of solar and wind generation.

That same cheerful outlook for renewable energy is echoed in the International Energy Agency’s World Energy Outlook 2017. The report suggests that among the four biggest shifts underway in the global energy system is the “rapid deployment and falling costs of clean energy technologies,” with new solar photovoltaics dropping by 70 percent since 2010, along with a 25 percent cost reduction for wind and 40 percent fall in battery costs. The report further shows trends toward renewables capturing two-thirds of power plant investment worldwide heading to 2040 as renewables become the lowest-cost source for many countries. Another key trend providing a boost to renewables is the electrification of energy consumption. According to the report, for the first time, in 2016, global investment in electricity outpaced investment in oil and gas.

What does all of this mean for college and university leaders as they plan their institution energy management agendas? For Wolfgang Bauer, it means the energy market is at a turning point such that every higher education institution can benefit in a substantial way from fuel switching. “You no longer have to choose between financial advantages and being green. Once you achieve a point where calculations tell you it is advantageous to invest in renewable sources over fossil fuels, by all means invest,” says Bauer, physics professor at Michigan State University, East Lansing, and a senior consultant to MSU’s executive vice president for administrative services. “You don’t have to go 100 percent,” advises Bauer. “Develop a plan to improve your financial position as you adjust your energy portfolio.”

Go Big

One way to move forward is through large-scale renewable energy procurement. To this point, many higher education institutions have been slowly tip-toeing into renewable energy through mostly smaller on-site projects, says Chris O’Brien, director of higher education programs for Edison Energy. While beneficial, this may represent a small fraction of the energy use of a particular building, let alone an entire campus, he adds. Now, the costs of large-scale procurement—and the contract structures to support these initiatives—have evolved to a point where energy buyers can make a much more substantial impact on their energy costs and carbon reduction goals, argues O’Brien.

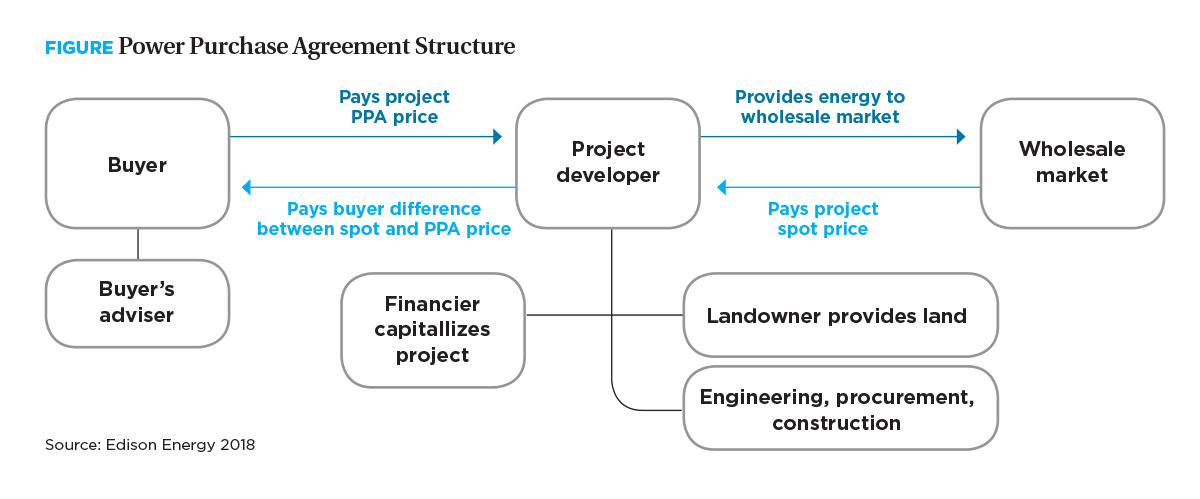

In terms of its basic structure, a power purchase agreement (PPA) allows a buyer or buyers to purchase power at a certain price for given time for a specific project. The promise to purchase the power is what finances the project, explains O’Brien. During the past decade, the higher education sector as a whole has partnered on hundreds of off-site PPA projects. The majority of large-scale renewable energy PPAs are structured as contracts for price differentials, notes O’Brien. These are mostly wind and solar projects with 10- to 15-year contract terms. Projects sell unit-contingent renewable energy to the buyer and receive the local market (“spot”) price. Likewise, explains O’Brien, projects provide environmental attributes like RECs (renewable energy certificates) to buyers, or energy if physical delivery is structured into the agreement. The buyer then pays a fixed process for the energy and captures the difference between the market price and PPA price. (See Figure, “Power Purchase Agreement Structure.”)

“Institution leaders should understand these agreements as an energy budget solution focused on reducing risk by introducing longer-term budget certainty,” suggests O’Brien. “For many decision makers, this may not be a problem they realized they had or that they needed to solve—in part because higher education leaders have learned to factor in the risk volatility of their energy supply,” notes O’Brien. One reason PPAs tend to make sense and work well within a higher education context is that most institutions prefer to reserve capital for campus investment—buildings, maintenance, new faculty, lower tuition. Explains O’Brien, “Rather than spending $50 million or $100 million on a new power plant, a PPA requires little or no capital outlay from the buyer.”

While a growing number of larger universities have embraced large-scale PPAs, these arrangements increasingly can make sense for institutions of any size, especially through agreements that aggregate the energy demand and supply for multiple entities.

Go Together

The Midwestern Higher Education Compact (MHEC) routinely develops and supports multistate agreements that allow public and private colleges and universities from its 12 member states to gain access to a variety of beneficial programs and services. The compact already supports agreements for health and property insurance and technology purchases. Now MHEC institutions are discussing ways to collectively lower overall renewable energy purchasing costs.

“Because our member states, by legislation, have granted large contracting authority to the compact, this not only allows for competitive pricing on group purchasing but also streamlines the bid process by eliminating duplication of this step for each individual state,” explains Rob Trembath, MHEC’s vice president and general counsel. The compact is currently still building awareness about its renewable electricity initiative, adds Aaron Horn, MHEC’s director for policy research. The next phase will entail selecting a technical adviser who can assist with identifying projects once a core group of institutions agree to participate.

The University of Minnesota, Minneapolis, is among the MHEC institutions already expressing interest in the aggregated model. Through a variety of efficiency measures and other renewable energy procurement initiatives, the university saves $3 million annually on utility costs. About 14 percent of its current energy purchase is 100 percent renewably sourced, says Shane Stennes, the university’s director of sustainability and co-chair of MHEC’s Environmental Sustainability Committee, which initiated the deliberations for a MHEC-sponsored PPA.

The compact is working directly with Second Nature and AASHE on laying the groundwork for a large-scale purchasing initiative. Both organizations are lending expertise through a series of educational workshops hosted throughout the region to help make sense of the complexities and nuances of aggregating renewable energy demand. For many smaller institutions, in particular, the best way to achieve economies of scale for fuel switching will be to work in partnership, notes Tim Carter, president of Second Nature.

When it comes to the scale of these energy projects, aggregation can play an essential role in addressing the size mismatch, adds Julian Dautremont-Smith, AASHE’s director of programs. “Through the workshops and other educational opportunities, we’re finding a wide range in the level of understanding of these kinds of agreements among institution leaders. Many have questions surrounding how PPAs work, how to structure an agreement, and how these differ from other ways of buying renewable energy.”

Horn warns that the complex nature of these agreements can be the reason why potential partners disengage. “It’s crucial to help leaders understand not only how these agreements work, but also how quickly the renewable energy sector is changing,” adds Carter. “Even if an institution evaluated an opportunity three years ago and didn’t find the economics in the institution’s favor, that same project might tip the scales today in favorability.” For Carter, what is truly exciting about MHEC is its ability to provide an efficient procurement mechanism for institutions of all types and sizes to curb energy costs and jointly tackle their emissions profiles.

Make an Impact

Other innovative cross-sector models for aggregating procurement are also taking shape across the country.

Summit Farms, a 60 MW solar PPA in North Carolina, has been up and running since early 2017. The project originated from conversations convened by A Better City, a collaboration of several dozen health-care and nonprofit organizations, education institutions, and businesses throughout the Boston area committed to making the city a better place to live and work. Ultimately, three members of the group agreed to partner on a large-scale project. Massachusetts Institute of Technology, Cambridge, made the decision to join midstream, explains Joe Higgins, MIT’s director of infrastructure business operations.

As the anchor partner in the PPA, MIT has a 73 percent purchase stake in the agreement. That share accounts for roughly 40 percent of the institute’s electricity use. The other two partners in the agreement are able to cover 100 percent of their electric needs through this deal. Boston Medical Center, a 500-bed academic medical center, holds a 26 percent stake in the agreement. The Post Office Square Redevelopment Corp., which manages an underground parking garage and a downtown Boston park, purchases 1 percent of the output.

- Partnering beyond the Northeast. The group selected the solar farm in North Carolina after reviewing 41 projects across 14 states, including wind projects in Texas and Maine, notes Higgins. While some institutions might give preference to or even require projects that are local or within the institution’s home state, MIT has a different view, explains Higgins. “Part of our criteria was to consider what might carry the greatest potential impact for the climate as a whole. If you look at our national grid, the Northeast is fairly clean by comparison to some other regions across the country, including in North Carolina, where a larger percentage of the region’s energy is derived from coal-fired plants.” The operation of Summit Farms has already allowed for a coal plant to come offline two years earlier than projected, reports Higgins.

- The value of additional entities. In researching projects, another big question MIT leadership had to address was why the institution should partner with other entities when this was something it could do on its own, says Higgins. “Ultimately, we mapped this project to MIT’s broader goals for establishing new market models. In our case, our project shows how a small, medium, and large entity can collaborate to bring a solution to market more quickly and thereby have a greater impact on the energy economy as a whole,” notes Higgins. “It’s a bit of a bygone era to assume you should do something like this on your own simply because you can. The real power comes from larger networks working at scale to leverage solutions together.”

- Include a research component. A core priority that MIT insisted on as part of the agreement includes opportunities to use the project to advance student research. “Current panel technology on many of these solar farms may be two decades old,” says Higgins. MIT is in the process of installing a real-time performance monitoring site on its campus using panels identical to those used in the Summit Farms array. “We plan to pilot other panel technologies and methods and compare their performance to the Summit Farms panels.” The idea, says Higgins, is that as MIT research identifies more efficient materials and methods, these can be incorporated into the Summit Farms array as part of MIT’s focus on expediting adoption of market solutions that are more effective and productive. The PPA deal with the developer is structured to allow for this, notes Higgins.

Involve Decision Makers

The six months during which MIT and its partners spent deliberating as a group, the institution did its own internal due diligence to determine risk. “I can’t overstate the broad educational effort that this requires,” says Higgins. “Not only did we have to learn how this project would work and understand the economics behind it, but we also had to [share] this with leadership. For a project like this to be successful, leadership must be involved from the beginning.”

More specifically, your chief business officer and treasurer need to not only be involved and willing to learn along with the rest of the group, but must also help lead the effort, argues Higgins. “While some on the team may look at this through the lens of sustainability—and it most certainly does advance a sustainability agenda—foremost this is a financial contract,” stresses Higgins. As a complex legal and financial obligation, it also requires input from risk managers, accounting staff, and energy officers. Otherwise, confusion can set in, says Higgins. “And anytime something gets confusing, the answer is usually no.”

For a multipartner, large-scale procurement initiative, collaboration among all stakeholders is crucial, concurs Laura Hubbard, vice president of finance and administration for the State University of New York at Buffalo. When she arrived at University at Buffalo (UB) six years ago, she introduced integrated resource planning, as a means to help the university approach complex initiatives through conversations that connect the dots.

That approach has helped focus internal discussions about the university becoming the lead partner of Localizing Buffalo’s Renewable Energy Future purchase initiative, a cross-sector group of Buffalo-based organizations exploring a large-scale PPA. The projected purchase of 100 MW of new solar energy would be installed throughout the city’s urban core—in parking lots, community centers, and fire and police stations, and on the campuses of UB, Buffalo State, and Erie Community College. Other partners in the proposed initiative include the city of Buffalo and Erie County.

Plans to implement the installations over the next four years are projected to infuse more than $250 million in economic impact for the region and yield $125 million in energy savings, with each partner committing to purchasing at least 25 percent of its energy requirements through the agreement. Keeping the installations local will increase transmission efficiency by bringing the generated energy closer to where it will be consumed and using existing electrical infrastructure. And, using existing physical structures like rooftops will help preserve farmland and other open-space assets, notes Ryan Mcpherson, UB’s chief sustainability officer. In addition to decreased energy costs, the goal of the community solar initiative is to create a “solar web” that will help ensure local grid resilience and lower greenhouse gas emissions.

“Getting everyone on the same page with each of these priorities can be a challenge,” says Mcpherson. He’s had to adjust his own thinking about the university’s climate action plan and UB’s goal of achieving neutrality by 2030 through the lens of the university’s business plan. “While we have made commitments in terms of our climate neutrality goals, at the end of the day, a project of this scale must first make business sense,” admits Mcpherson.

Allow for Flexibility

It also has to make sense for each partner involved, notes Hubbard. “This is a journey of exploration and a process of identifying opportunities. And it’s not a given that all who start the process will ultimately sign the final agreement.” One of the challenges in a partnership of this nature is that each entity may have different legal requirements or different internal practices. Despite agreement on a shared goal, you have to account for each entity maintaining the freedom to implement the agreement differently, notes Hubbard.

One example of allowing autonomy to address specific concerns is to let each entity follow its own procurement processes, advises Tonga Pham, UB’s associate vice president for university facilities. “Especially when getting down to the contract details, you may need some arbitration to guide you through the group process and timeline.”

Likewise, the differences between a municipality and a state agency, for instance, may require multiple versions of a contract to allow for each partner to satisfy and adhere to its different legal structures and requirements. “This is where it really helps to have the expertise of an adviser, who can bring everyone together,” adds Mcpherson. He admits that he knew little about PPAs and how they work until three years ago when he attended an AASHE half-day boot camp. That said, UB is no stranger to solar. In 2006, the university installed a 75 kW rooftop system that generated 6 percent of the building’s annual electrical power at $13 per watt installed. In 2009, UB partnered with the New York Power Authority to construct a 750 kW ground-mounted system at $9 per watt hour. By 2012, the price per watt for on-site solar had plummeted to $2.50 per kWh, notes Mcpherson.

The sharp decrease in the price of solar in recent years has now made it possible for university leaders to entertain a large-scale purchase agreement, says Mcpherson. “While we haven’t wanted to be first out of the gate, enough examples now exist of other institution partnerships to provide some solid understanding of lessons learned.” (See sidebar, “Word to the Wise.”)

Make Use of Incentives

Some states are leaning in with their renewable energy portfolio standards. New York State’s Clean Energy Standard calls for 50 percent renewable energy use by 2030. Government officials understand that the state can’t get there without the strong participation of its State University of New York (SUNY) and City University of New York (CUNY) higher education communities. Numerous state-level grants have helped incentivize movement in this direction for innovation and action in public and private institutions. (See sidebar, “Partnering for Solar Power in New York City.”)

- SUNY Cortland steps up. In recent years, the SUNY Cortland campus has emerged as an eager participant. It has already embraced 100 percent renewable electric power through a combination of on-site ground- and roof-mounted solar and RECs. At present, SUNY Cortland’s aggregate REC purchase on the national market represents about 71 percent of the university’s electricity needs. “This percentage will continue to decrease as renewables account for a greater percentage of what we generate,” says Matt Brubaker, SUNY Cortland’s energy manager. Currently, that represents about 24 percent of the university’s electric consumption. Contributing to this is SUNY Cortland’s 3,600-panel, 1.06 MW project with SolarCity installed on three locations across the campus. This project was the first in the state for an on-site, behind-the-meter installation using a PPA as the financial delivery model, notes Brubaker.

- Bundling can bring benefits. Projects in the pipeline include plans to participate in a large-scale renewable energy PPA that would bundle public and private higher education institutions within New York as a means to develop more renewable energy resources within the state. The proposed venture began as a general conversation two years ago at a conference with representatives from University at Albany, New Paltz, and several other campuses, notes Brubaker. “In follow-up to that meeting, we surveyed SUNY campuses to see how many had been looking into solar either on or off site, and from that we established a list of interested parties that might want to pool resources for a large-scale project,” says Brubaker.

In September 2017, several in the group presented information to the SUNY System about the desire for large-scale renewable energy procurement. Currently, the group is circulating a letter of intent and support among the finance vice presidents at 14 institutions. The project would likely combine on-site solar installations on certain campuses with development of new off-site resources within the state, says Brubaker.

Explore Options

Chesapeake College, founded in 1965 in Wye Mills, as Maryland’s first regional community college, serves a five-county area that encompasses nearly 20 percent of the state’s land mass but represents only 3 percent of its population. Because of its rural setting, the campus has to provide for much of its own infrastructure needs, including all freshwater capability, notes Tim Jones, vice president for administrative services. Since 2012 when sustainability became a primary stated objective within the college’s strategic plan, focused efforts on energy efficiency have helped reduce power consumption by 26 percent.

- Reducing peak energy demand. One early project was the installation of a 50 kW wind turbine on campus. While it produced only a small percentage of the college’s power needs, it served as a symbol for the surrounding area and got the ball rolling for brainstorming other initiatives, says Jones. Unfortunately, six months ago a lightning strike damaged the turbine. Repair assessments didn’t show enough of a savings to replace it, so the college opted instead to replace a chiller that was nearing the end of its useful life. The new chiller’s 30 percent efficiency gain alone provides for a nearly 10 percent reduction in the peak energy demand on campus, notes Jones. The college has also been exploring and implementing a range of lighting efficiency and renewable energy projects in recent years. Currently, about 45 percent of campus buildings are on a geothermal loop, reducing heating and cooling costs.

- Earmarking space for solar. More recently the conversation turned to solar. “We are fortunate in that we have a large land footprint for our size,” notes Jones. Of Chesapeake’s 173-acre campus, about 70 acres remain unused by campus buildings. College leaders spent roughly a year researching the solar initiatives of other institutions to determine what might work for Chesapeake. They settled on an on-site photovoltaic solar installation projected to offset the college’s grid-supplied power by 40 percent.

Through its RFP process, Chesapeake’s leaders determined the need to stay under 2 MW of generation—the threshold above which additional state-level net-metering regulation would kick in, notes Jones. In addition to setting aside a six-acre area on a far corner of the campus for the solar array, the project incorporated a parking lot canopy as a visible statement for college occupants and visitors. From 12 bids, the college selected SolarCity’s proposal for a 1.76 MW project. In traditional PPA fashion, the college agreed to purchase the power but would have no costs associated with the array’s design, construction, operation, or maintenance. In the first full year since the array came online, the college’s annual electric costs dropped by approximately 40 percent—from $600,000 to $350,000, notes Jones.

- Building battery storage. In the process of working through all the regulatory requirements for interconnection with the local grid, officials from Delmarva Power—the college’s electric utility provider—became aware of Chesapeake’s strong interest in renewable energy. “This began conversations about having our campus be partners in a pilot demand/response test program that would allow for real-time monitoring and the capability to dial down the college’s electric usage to maintain grid stability during peak periods,” says Jones. And, as a result of this partnership, Delmarva once again collaborated with the college to secure a grant from Maryland’s energy administration to use space on the college campus to build a 1 MW battery storage test project.

This energy storage capability will provide a level of operating resilience not only for the college, explains Jones. Chesapeake serves as a dedicated shelter in the region in the event of a natural disaster and as a mass immunization location for the county in the event of an outbreak. “Five years ago, we didn’t have any partners in these efforts,” says Jones. Simply by being curious and doing the research, the college has immeasurably boosted its sustainability profile, adds Jones. “One lesson from this for us is to explore opportunities as they arise. Then start the dialogue, because the conversation is free.”

Make Changes That Make Sense

In his role as senior consultant to Michigan State’s executive vice president for administrative services, Wolfgang Bauer keeps busy identifying projects to boost MSU’s consumption of renewable energy. He co-authored MSU’s energy transition plan, which outlines an aggressive schedule of emissions reductions and inclusion of renewable energy into the university’s power portfolio.

“A No. 1 imperative for our institution is energy reliability,” says Bauer. While the university is still tied to a larger external grid, it has been working to improve connection with a 100 MW substation, which it had built two years ago as a safety net. MSU has long held the right to generate its own power behind the meter, explains Bauer.

Knowing that the university wanted to increase its share of renewable energy through a large-scale project, about three years ago MSU leaders engaged an adviser to uncover the best available opportunities. No specific criteria were enforced regarding whether that project should be on-site or off-site, or whether it incorporate hydro, solar, wind, or geothermal, says Bauer. As of December 2017, MSU’s new 10 MW on-site solar array became fully operational, financed through a PPA.

“While we looked at wind, we settled on solar because that offered us the best peak-shaving opportunities in summer when we need the power most for air conditioning,” explains Bauer. University leaders also determined it would be most efficient to find an on-site solution to maximize MSU’s behind-the-meter power capacity.

“We also considered ground mount, but at that scale it would have placed a large requirement on our available land, and our College of Agriculture in particular did not want to see 50 acres of farmland given over to an array,” notes Bauer. Instead, the parking canopies installation utilizes five existing lots. Essentially no improvements were needed other than drilling holes for the foundation, notes Bauer. “We didn’t even lose any existing parking spaces”—of concern to MSU’s substantial commuter population.

Construction took roughly nine months, from March to December 2017. The only real cost to MSU was less than $2.5 million to connect the solar PV arrays to the university’s electrical system. The deal is structured as a 25-year fixed-price contract, but this is also open for negotiation with the developer through a buyout clause, notes Bauer. The earliest MSU could consider transfer of ownership would be at the seven-year mark, based at that time on fair market value and how much the assets and performance have depreciated, explains Bauer.

- Results and predictions. Even though the canopy arrays haven’t yet been exposed to their maximum capacity of daylight, they already are performing almost 10 percent better than expected based on calculations for time of day and day of year for Michigan’s latitude, notes Bauer. And, based on forward-looking predictions from the Department of Energy, Bauer reports that MSU stands to save roughly $10 million in electricity costs over the duration of the project relative to producing that same electricity via fossil fuels. In addition to moving toward more renewable energy investment, MSU has been able to significantly lower emissions since making the full switch two years ago from coal to natural gas, a change introduced gradually over a decade while taking advantage of falling natural gas prices, says Bauer.

- Considering combinations. To continue moving MSU toward a higher percentage of renewable energy consumption, Bauer is keeping his eyes trained on the cost curve of additional opportunities. MSU previously invested in a biogas facility that produces about one-third of the annual energy of the solar array. For certain applications this is preferable because energy is generated at a constant level, notes Bauer. He can envision extending biogas production in addition to more solar or even on-site wind. “Ten years ago, wind would not have been sufficient for our campus. Now, the capacity of the turbines has greatly improved to work well even in areas with low to medium wind resources like we have here,” notes Bauer. The university is also seriously considering investment in geothermal, since two-thirds of MSU’s fossil fuel consumption is directly attributable to keeping campus buildings warm in the winter.

Another potential game changer for MSU is the steady decline in costs for battery storage solutions, says Bauer. “Once you have storage behind solar you can almost completely isolate yourself from demand fluctuations.” While there are no concrete plans in place for the university’s next big shift toward renewable energy sourcing, one thing is certain, notes Bauer: “We need to first be convinced of the cost effectiveness of any project we undertake. Our guiding principle is that it must be fiscally feasible as well as environmentally sustainable.”

Embrace Your CBO Role

In addition to reducing greenhouse gas emissions, a strong renewable energy procurement strategy can increase energy resilience and help mitigate price volatility associated with conventional fuels, notes Gary Farha, president and CEO of CustomerFirst Renewables. “For institution leaders intent on pursuing the best renewable energy mix for their institutions, a number of challenges and concerns may emerge in discussions about large-scale renewable energy purchasing,” notes Farha. These include questions surrounding:

- The special nuances of on-site versus off-site projects.

- The reputation and viability of developers and investors.

- The siting of projects.

- Related concerns about transmission.

- What renewable sourcing looks like compared to other energy sources.

- What happens if you overlay storage to augment or improve economics of intermittent renewables.

- Impacts to current power supply and reliability.

“Ultimately these questions lead to understanding how you can layer more renewable energy into your overall supply portfolio in a smart way, since any solution you seek should be as good as or better than what you currently have in place,” cautions Farha. His work with businesses and higher education institutions is focused on first determining broad energy strategies and then identifying specific opportunities to pursue.

The first order of business is to recognize the complexity of this slice of the energy marketplace, insists Farha. Among the complexities surrounding large-scale PPAs is the preponderance of different policies, programs, standards, and incentives in place within each state or region. The good news is that while the opportunities for large-scale renewable energy procurement may look different depending on whether you are in a regulated or a deregulated market, options exist regardless of your circumstance, stresses Farha. Other good news: While large-scale renewable energy projects/contracts have typically ranged from 20 to 25 years, the trend is toward shorter-term deals. Today, institutions might anticipate contract lengths of 12 to 15 years or even shorter depending on the project, notes Farha.

If partnering with other entities, questions related to aggregating purchase include how to create organizational understanding and buy-in among all stakeholders and partners, and how to build the business case to educate others. The latter includes effectively demonstrating the economic impact of solutions, including cost savings and risk mitigation. “Much of this work is geared toward setting up the effort for success from the outset,” says Farha. This entails not only goal-setting, but also how to organize the project, assemble the right crossfunctional team, and draw people in at the right times. “Keep in mind that these deals are not binding until you sign. They begin with a conversation and require a spirit of exploration. Be prepared to work through issues together, and understand that each partnership and each deal is unique,” says Farha. “There is no singular philosophy, approach, or project type.”

Finally, says Farha, any participation in an agreement should pair with institution mission and energy strategy. “Bottom line, the chief business officer is the key decision maker here. This is a business transaction that requires due diligence, so it does not or should not happen without the CBO’s input and influence.”

KARLA HIGNITE, New York City, is a contributing editor for Business Officer.