Despite an improving economy, many college students and their families continue to have a high need for financial aid to pay their postsecondary expenses. The University of Tulsa, Tulsa, Okla., has increased its expenditures for institutional scholarships, grants, and other student financial aid awards in order to meet these needs.

“Our student population has seen a rapid increase in need [for financial aid], and we have reallocated our aid structure to give more emphasis on need-based funding,” says Kevan C. Buck, executive vice president for finance, operations, and administration, and corporate secretary and treasurer. From academic year 2017–18 to 2018–19, the University of Tulsa’s spending on its TU Grant program rose from about $1.6 million to $2.5 million, and the number of students receiving these awards grew nearly 55 percent.

The University of Tulsa is not alone in expanding its institutional aid budget. Nationally, colleges and universities spent nearly $48 billion to providefinancial assistance to undergraduatesin 2017–18, according to the College Board. Between academic years2012–13 and 2017–18, total institutional grant and scholarship spending increased by $10.4 billion in inflation-adjusted value, rising from 20 percent of total aid awarded to undergraduates to 26 percent. The total amount of institutionally funded scholarships to undergraduates is now greater than the amount of federal and state grant and scholarship programs combined.

While providing educational opportunities for all families—regardless of their financial circumstances—is an important goal for institutions, the cost of achieving it may be too high for many collegesand universities. According to the 2018 NACUBO Tuition Discounting Study, supported by the EAB, more chief business officers and other industry experts are becoming increasingly concerned about ever-rising discount rates. CBOs are seeking new ways to meet students’ needs that are more financially sustainable for the long-term financial futures of their institutions.

Ever-Higher Discount Rates

While all types of higher education institutions award scholarships and grants to meet students’ financial needs, rising aid expenditures have been particularly noteworthy at private, nonprofit colleges and universities because these schools are more dependent on tuition and fee revenue to fund their operations. For this reason, NACUBO’s annual tuition discounting study (TDS) has focused exclusively on the discount rates and institutional grant allocations at private nonprofit colleges and universities.

The 2018 TDS is based on results from 405 independent institutions that were NACUBO members as of September 2018. These participating schools provided their final aid expenditures and other data for academic year 2017–18 (as of fall 2017) and preliminary results for 2018–19 (as of fall 2018).

The TDS measures the effect institutional grant aid expenditures have on college and university finances. The two key statistics in the report—the institutional discount rates—measure total institutional grant dollars awarded by participating schools as a percentage of the gross tuition and fee revenue they collect both from first-time, full-time freshmen, and from all undergraduates.

The aid dollars in the study include: undergraduate grants, scholarships, and fellowships that are funded by tuition and fee revenue; and scholarships and grants that are funded by restricted and unrestricted endowment funds, general investment earnings, donations to the institution’s general scholarship/financial aid fund, and other sources of revenue. Aid dollars to graduate and professional students and spending on tuition remission and tuition exchange programs are not included.

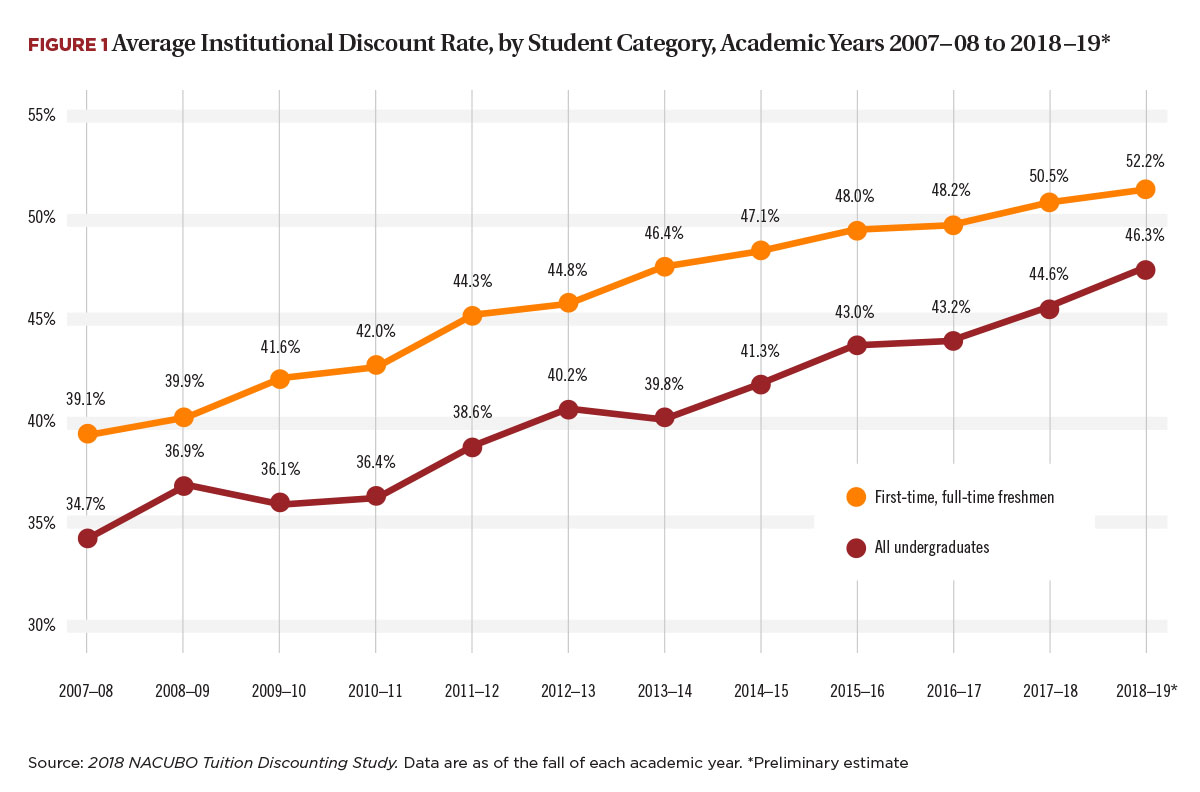

Institutional tuition discount rates reported in the TDS have been rising for much of the past decade, but in recent years the growth of discounting appears to have been accelerating. Between academic years 2016–17 and 2017–18, the average institutional tuition discount rate for first-time freshmen grew by more than two percentage points, to a record high of 50.5 percent (see Figure 1). For 2018–19, early projections suggest that the average freshmen rate will climb even higher, to an estimated 52.2 percent.

The average rate for all undergraduates, while lower, is on a similar growth trajectory, rising from 43.2 percent in 2016–17 to 44.6 percent in 2017–18. The 44.6 percent discount rate for all undergraduates suggests that, on average, for each dollar of tuition and fee revenue that private nonprofit colleges collect from undergraduates, they return nearly45 cents to aid recipients in the form of institutional grant awards.

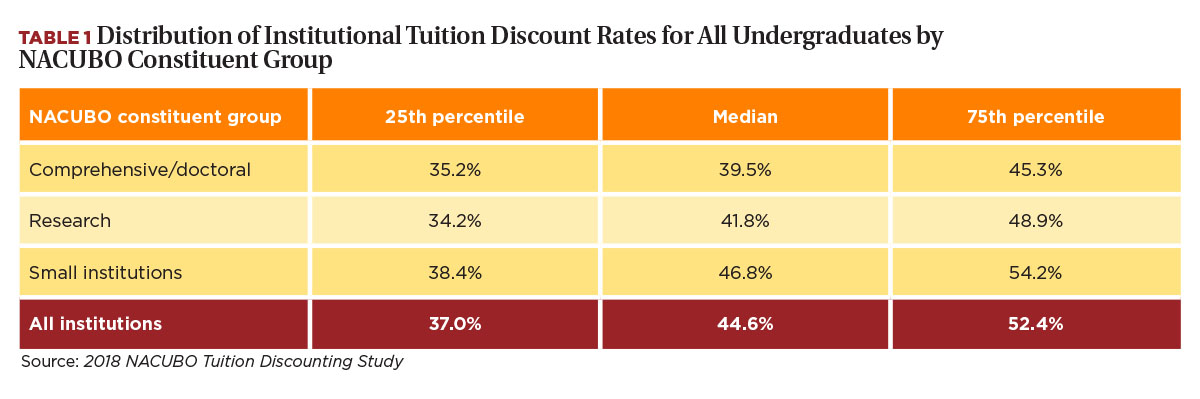

In addition, while the overall average discount rate for all undergraduates was 44.6 percent in 2017–18, some institutions had rates that were considerably higher than the average, while some others had rates that were well below. About 25 percent of small institutions (those with fewer than 4,000 enrolled students) had all-undergraduate discount rates of 54.2 percent or higher, while another 25 percent had rates that were 38.4 percent or lower (see Table 1). Research and comprehensive/doctoral institutions also had wide variations in their upper- and lower-percentage distributions of discount rates.

For Kathy Dawley, managing director, client success, EAB, and a former member of the board of trustees at Regis College, Weston, Mass., the overall higher levels of tuition discounting are evidence that the current institutional financial aid practices at many schools are not financially sustainable for most institutions. “Concerns about discount rates are acute at all types of institutions,” Dawley says. “Many governing boards are expressing considerable anxiety about the discount rate and are beginning to mandate that their institutions take steps to gain control of their aid spending.”

Declining Net Revenue

One reason for the rising concern among governing boards is that rising discount rates at many private colleges are leading to flat or declining net tuition revenue. As Dawley explains, “In the past, institutions could increase their grant spending and that alone would generate new enrollment and dollars. Now, most schools are seeing that increases in discounting no longer translate into greater net revenue.”

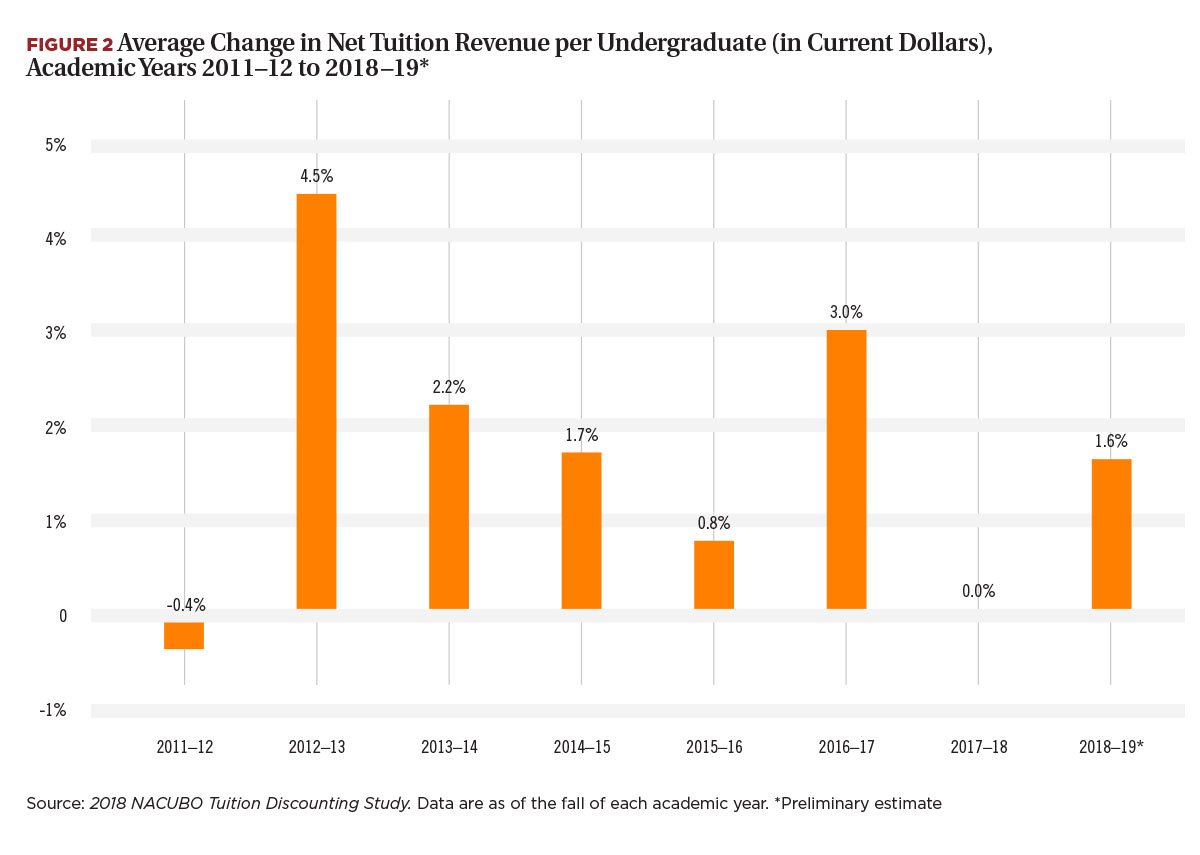

Indeed, in 2017–18, net tuition and fee revenue per undergraduate—calculated as gross tuition and fee dollars minus institutional grant aid—was essentially flat in nominal (not adjusted for inflation) value (see Figure 2). This lack of growth in net revenue is further exacerbated by inflation as measured by the Commonfund Higher Education Price Index, which rose by an estimated 2.8 percent in FY18. Thus, the zero percent current dollar change in net revenue equates to a 2.7 percent drop once inflation is taken into account.

Seeking New Strategies

Slower growth in net tuition revenue may have a chilling effect on the overall finances of many independent institutions. According to the National Center for Education Statistics, in 2015–16, four-year, private nonprofit colleges derived approximately 40 percent of their total funding from net tuition and fees. Further declines in this revenue source may limit the ability of institutions to fulfill their educational and public-service missions.

As a result, many campuses have started to take a closer look at their current strategies and have decided that these trends are no longer financially viable. The University of Tulsa, for instance, has begun to take steps to gain greater control over its grant expenses. “We have experienced declining yields in the entering student population over the past several years, which might suggest that we do even more discounting,” Buck says. “We have instead chosen to stay the course and not further increase the discount. We are in the process of implementing a program that reduces the tuition discount rate over a five-year period, which should put the university in a position where it needs to be.”

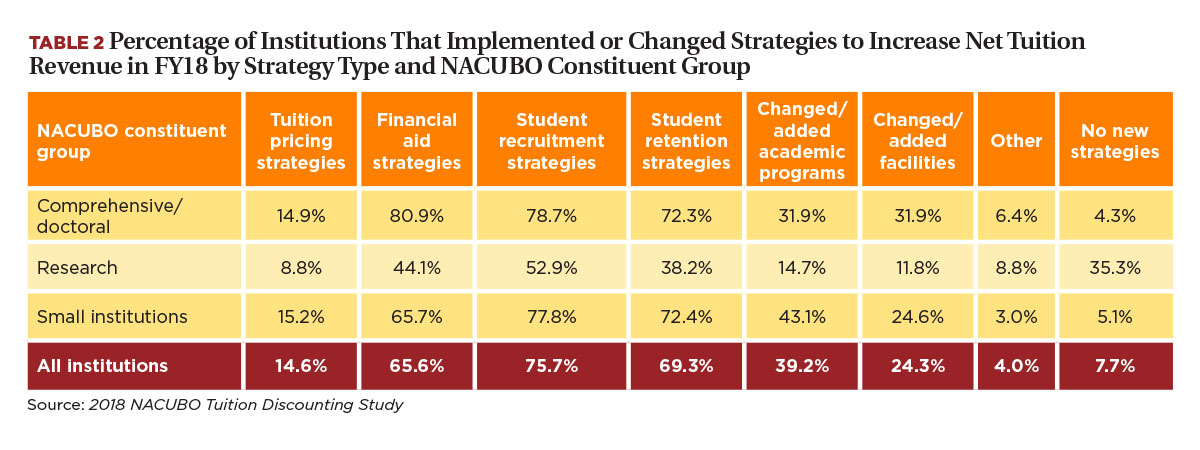

The University of Tulsa’s efforts to rethink its tuition discounting strategy mirror the efforts of many other institutions. The TDS asked campuses to identify what other strategies they have implemented or had planned to change in 2017–18 to increase their net revenue. Student recruitment and retention were the most widely new or changed strategies cited (see Table 2). More than three-quarters of survey participants said their colleges changed or planned to use new student recruitment strategies, while 69.3 percent focused on student retention. (As many institutions try many different approaches simultaneously, respondents were allowed to select more than one type of strategy.) The use of new or changed strategies also varied by type of institution. For example, a slightly higher share of small institutions said that they have changed tuition pricing strategies and have changed or added academic programs. Comprehensive/doctoral institutions, on the other hand, were the most likely to cite new or changed financial aid strategies. Research universities were the most likely to say that they had not used any new strategies.

These findings may suggest that more institutions are trying new approaches to meet their students’ needs in a more financially sustainable way—a movement that Dawley applauds. “Schools have a much greater interest in connecting tuition pricing, revenue, and enrollment,” she says. “This is leading colleges to try new approaches that aim to right-size the budget for financial aid with students’ net price, as opposed to just the listed sticker price. Institutions are also creating new programs that will meet the needs of a greater demographic of students, such as older adults and veterans, which are showing promise for greater growth than the traditional-age population.”

In the long-run, these and other alternatives to tuition discounting may help guide institutions toward greater control of aid spending. But in the short term, pressures to increase grant awards to students will likely continue. Like many institutions, the University of Tulsa is preparing to meet these challenges head-on. “All universities are affected by the need to decrease the tuition discount rate. We have reached the point where colleges are not in a position to continue to discount tuition at the current levels and remain sustainable. But the academic core values of our university will continue to be an area that is protected even if the fiscal pressures linger.”

KENNETH E. REDD is senior director, research and policy analysis, NACUBO.