The Financial Accounting Standards Board (FASB) has made final decisions on the first phase of its not-for-profit reporting project and will release a new standard in early summer. The accounting update will be effective for independent institutions in FY19.

Meanwhile, the Governmental Accounting Standards Board (GASB) is making great progress on assessing the effectiveness of its current reporting model.

FASB: Ready, Set, Done

One year ago, the FASB issued a proposed Accounting Standards Update (ASU) aimed at improving financial reporting for not-for-profit organizations (NFPs). Based on feedback received on that proposal, FASB decided to divide its redeliberations of the project into two phases. The first phase reconsidered proposed changes that were not dependent on other projects and for which feedback—either positive or negative—was relatively consistent.

The second phase, which may begin as early as the second half of 2016, will involve reconsideration of the proposed changes that are likely to require more time to resolve—most notably, requiring a defined operating measure and realignment of certain line items in the statement of cash flows.

The board has completed redeliberations on Phase 1 of the project, and FASB staff have drafted the final standard, which is expected to be issued this summer. Following is a summary of the tentative decisions reached in Phase 1:

- Net assets. The three classes of net assets used today will be replaced with two classes: those with donor-imposed restrictions and those without. In order to ensure no loss of information, the board reaffirmed the proposed requirement to provide relevant disclosure about the nature and amounts of donor restrictions on net assets, either on the face of the statements or in the notes. In addition, amounts and purposes of board-designated net assets will be required to be presented.

- Underwater endowments. Rather than reducing unrestricted net assets for amounts by which endowment funds are underwater, those amounts will be reported within net assets with donor restrictions. In addition, institutions will be required to disclose their policy for spending on underwater endowments and the aggregate original gift amounts of underwater funds, along with the fair value of those funds.

- Expiration of capital restrictions. The current option to imply a time restriction that expires over the useful life of an asset, sometimes referred to as the “bleeding-in” method, will be eliminated. Instead, restrictions on capital assets will be released when the asset is placed in service.

- Reporting of expenses. An analysis of operating expenses by both their function and nature in a single location—generally in the notes—will be required. Enhanced disclosures about how costs are allocated among functions will also be required.

- Investment expenses. Investment returns will be presented net of external and direct internal expenses. The current requirement to disclose the amount of netted investment expenses will be eliminated. In addition, NFPs will no longer be required to display the investment return components (income earned and net realized and unrealized gains or losses) in the roll-forward of endowment net assets.

- Operating measure disclosures. NFPs that utilize an operating measure and show governing board designations, appropriations, and similar actions within that measure will be required to disaggregate and describe them by type (either on the face of the financial statements or in the notes).

- Statement of cash flows presentation. An organization may choose to present cash flows from operations using either the direct or indirect method. For those that choose to use the direct method, the indirect reconciliation will no longer be required (but may still be provided if desired).

- Liquidity and availability. NFPs will be required to provide both qualitative and quantitative information about liquidity and availability as follows:

- Qualitative information that communicates how an NFP manages its liquid resources available to meet cash needs for general expenditures within one year of the balance sheet date.

- Quantitative information that communicates the availability of an NFP’s financial assets at the balance sheet date to meet cash needs for general expenditures within one year of the balance sheet date. The availability of a financial asset may be affected by its nature; external limits imposed by donors, laws, and contracts with others; and internal limits imposed by governing boards.

- Transition and effective date. The standard will be effective for fiscal years beginning after Dec. 15, 2017 (FY19 for most institutions). Early adoption will be permitted, but an NFP must implement all provisions of the standard at the same time. NFPs that present comparative financial statements may choose to present the expense analysis and liquidity disclosures for the current year only.

Once the standard has been issued, NACUBO’s Accounting Principles Council will begin to develop examples specific to higher education for use in adopting the standard.

GASB: Governmentwide Comment Period Coming Soon

The GASB is in full swing with a project to assess the effectiveness of its current reporting model, which has been in use for more than 15 years. Throughout 2016, the board has been addressing governmentwide and fund financial statements, with an “invitation to comment” expected later this year. Next up for the Governmental Accounting Standards Board: Business Type Activity Financial Statements.

In December, the board will begin to address operating indicator and presentation alternatives for operating and nonoperating revenues and expenses in business-type activity (BTA) financial statements. Board members and staff have heard from preparers, users, and auditors that the current operating presentation is misleading for stand-alone BTAs, such as public colleges and universities.

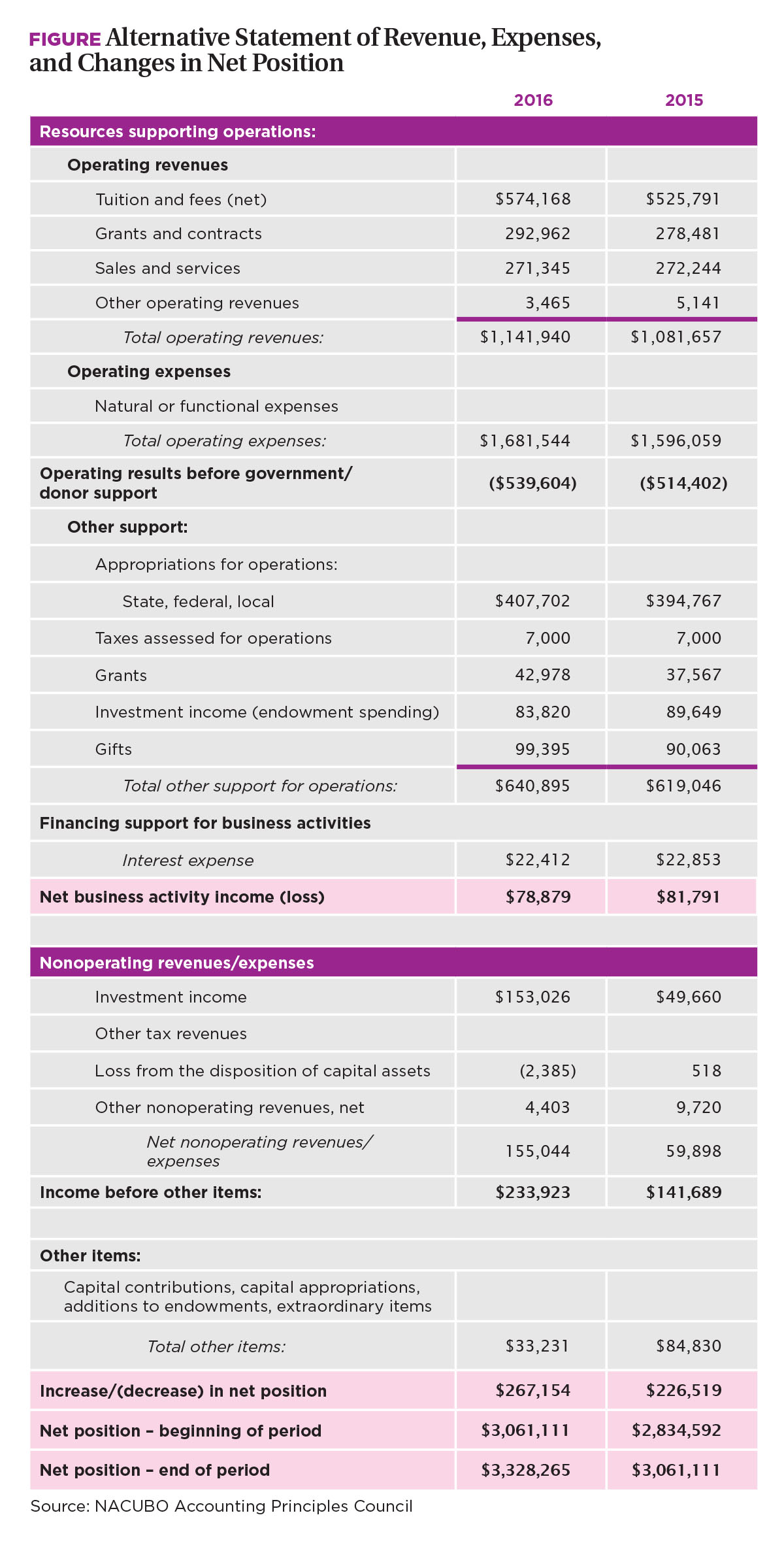

NACUBO hopes that GASB will consider alternate presentations for the “Statement of Revenue, Expenses, and Changes in Net Position,” put before the board by its Accounting Principles Council. The figure shows one alternate format that separately displays fee for service (exchange) and support (non-exchange) revenue with subtotals to illustrate how funding impacts operating and business results. Charles Tegen, associate vice president for finance, Clemson University, Clemson, S.C., represents higher education on the project task force. NACUBO will keep institutions informed on GASB’s progress throughout the year.

NACUBO CONTACT Sue Menditto, director of accounting policy, 202.861.2542