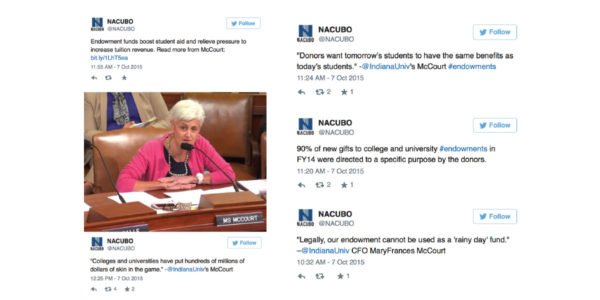

The U.S. House of Representatives Committee on Ways and Means Subcommittee on Oversight held a hearing on October 7, on the rising costs of higher education and the possible role of the nation’s tax policies. NACUBO was invited to testify on the role of college and university endowments; and MaryFrances McCourt, senior vice president and chief financial officer, Indiana University, Bloomington, served as the association’s witness at the hearing.

“Today we’re here to look at what’s behind the rising cost of college, and to consider whether this nation’s tax policies are partly to blame,” said Subcommittee Chairman Peter J. Roskam (R–IL) in his opening statement. Roskam also raised the idea—made popular in 1987 by former Secretary of Education Bill Bennett—that increases in federal financial aid allow colleges to raise their tuition rates; this concept is known as the Bennett Hypothesis.

In her opening statement, McCourt said, “I take very seriously the responsibility to deliver on the public purpose of higher education, to enhance intergenerational mobility, and to drive the knowledge creation and innovation that supports economic growth. … As demographic, geographic, financial, and cultural forces reshape our economy, we are using the sophisticated business analytics to implement our mission and optimize our operations to meet the expectations of all of our stakeholders—from parents and students, to our donors, to the U.S. economy writ large.”

Explaining Endowments

At the hearing, the subcommittee asked that NACUBO discuss college and university endowments, to help lawmakers and the general public gain a better understanding of how endowments are designed to work; how much spending comes from endowments; and the purposes to which those withdrawals are applied. In recent months, along with a continued focus on student debt levels and college costs, public attention also turned to college and university endowments, and critical opinion pieces have appeared in the national media.

This hearing provided NACUBO an opportunity to illustrate how institutions use endowments to address access and affordability, sharing data from the 2014 NACUBO-Commonfund Study of Endowments and other information about endowment management. McCourt’s written statement explained the fundamental guidelines that investment managers and boards of trustees must adhere to when managing endowments, pointing out, “Endowed funds represent an institution’s promise to donors to use income and investment gains generated by their gifts to support an aspect of the university’s mission into perpetuity. Donors who direct their gifts to endowments expect institutions to strike a balance between supporting current needs and ensuring the funds meet the needs of future generations, meeting the mission and needs of students and the campus community here and now, as well as long into the future.”

Exploring Other Cost Drivers

The other witnesses at the hearing were David Lucca, research officer, Federal Reserve Bank of New York; Richard Vedder, distinguished professor of economics, Ohio University, Athens; Brian Galle, professor of law, Georgetown University, Washington, D.C.; and Terry Hartle, senior vice president, American Council on Education.

“College presidents understand the importance of this issue and the extraordinarily high levels of public concern,” Hartle noted in his opening statement. He stressed the impact of steep cuts in states’ operating support for public higher education, as well as three other important cost drivers for institutions of higher education: labor, technology, and government regulation.

McCourt pointed out that at Indiana University, “the dramatic erosion of state support has been our most challenging financial pressure. In the mid-1980s, state operating appropriation made up 58 percent of the general education fund budget, and tuition and fees made up 26 percent. That ratio has now completely flipped.” She continued, “However, we have managed to thrive through our focused attention on running efficient operations to reallocate resources for strategic investment. Historically, low tuition increases are our ‘new normal.’”

Roskam voiced concerns with the growth in administrative staff at colleges and universities as well as executive compensation rates. He stated, “For nonprofit institutions, it seems like a lot of university presidents are making very good money. … One way schools can justify their compensation as ‘reasonable’ to the IRS … is to show that similarly situated institutions pay comparable salaries to their executives. How does tax policy fit into that math?”

Other Republican lawmakers at the hearing pointed out that, since endowments enjoy tax-exempt status and the donations they receive are deductible, there is a question as to whether institutions are doing enough to keep costs down and to provide tuition relief.

During the two-hour hearing, significant discussion centered on the Bennett Hypothesis. A recent Federal Reserve Bank of New York draft report—of which Lucca is a co-author—draws some conclusions in support of the theory. Hartle, however, disputed the report’s findings because it looks at sticker price versus net tuition and state funding, and did not factor in consideration of the substantial declines in state support as drivers of tuition prices.

“The first tuition checks of the year are clearing the bank, and families are figuring out how to make ends meet during one of the biggest financial challenges in modern life, and that is, figuring out how to pay for the cost of college,” Roskam stated. McCourt conveyed that institutions, too, are responding today to an array of pressures that will determine their financial condition, not only now but also in the future. During an exchange that questioned whether institutions are doing enough, she pointed out that, “colleges and universities have put hundreds of millions of dollars of skin in the game.”

Rep. John Lewis (D–GA), the ranking Democrat on the subcommittee, took a different approach in his remarks, focusing on the broader role that higher education plays in the overall economy and supporting investments in student aid. Lewis remarked, “Institutions of higher learning play a key role in expanding opportunity and reducing income inequality for those who have been left out and left behind for far too long. … Federal student aid programs—like Pell grants and student loans—are critical tools to ensure that a college education is affordable and accessible for all who aspire. In light of decreasing state support for higher education, it is more important than ever for the federal government to do our part and play a role.”

Projected Outlook

NACUBO expects lawmakers to continue to put a spotlight on colleges and universities in the coming months. McCourt readily and confidently responded to concerns raised at the hearing with clear information about institutions’ investment in students. As public scrutiny persists, chief business officers should be prepared to tell the story of their efforts to find cost efficiencies and stretch resources and the “skin in the game” that their colleges and universities already invest in their students.

NACUBO CONTACT Liz Clark, director, federal affairs, 202.861.2553, @lizclarknacubo